After some debate, the county took a leap of faith Monday, approving its first tax-increment financing (TIF) district which it hopes will help spur development in the future Interstate 69 corridor.

Two Johnson County boards met Monday to finalize the TIF district, one of two that have been on the table for months. A proposed Interstate 65 TIF district remains in limbo after city and town officials expressed concerns about its intent and impact on Franklin, Greenwood and Whiteland.

The Johnson County Redevelopment Commission went first, voting 4-0 with one member absent to approve the I-69 TIF district. The Johnson County Board of Commissioners went second, approving it unanimously.

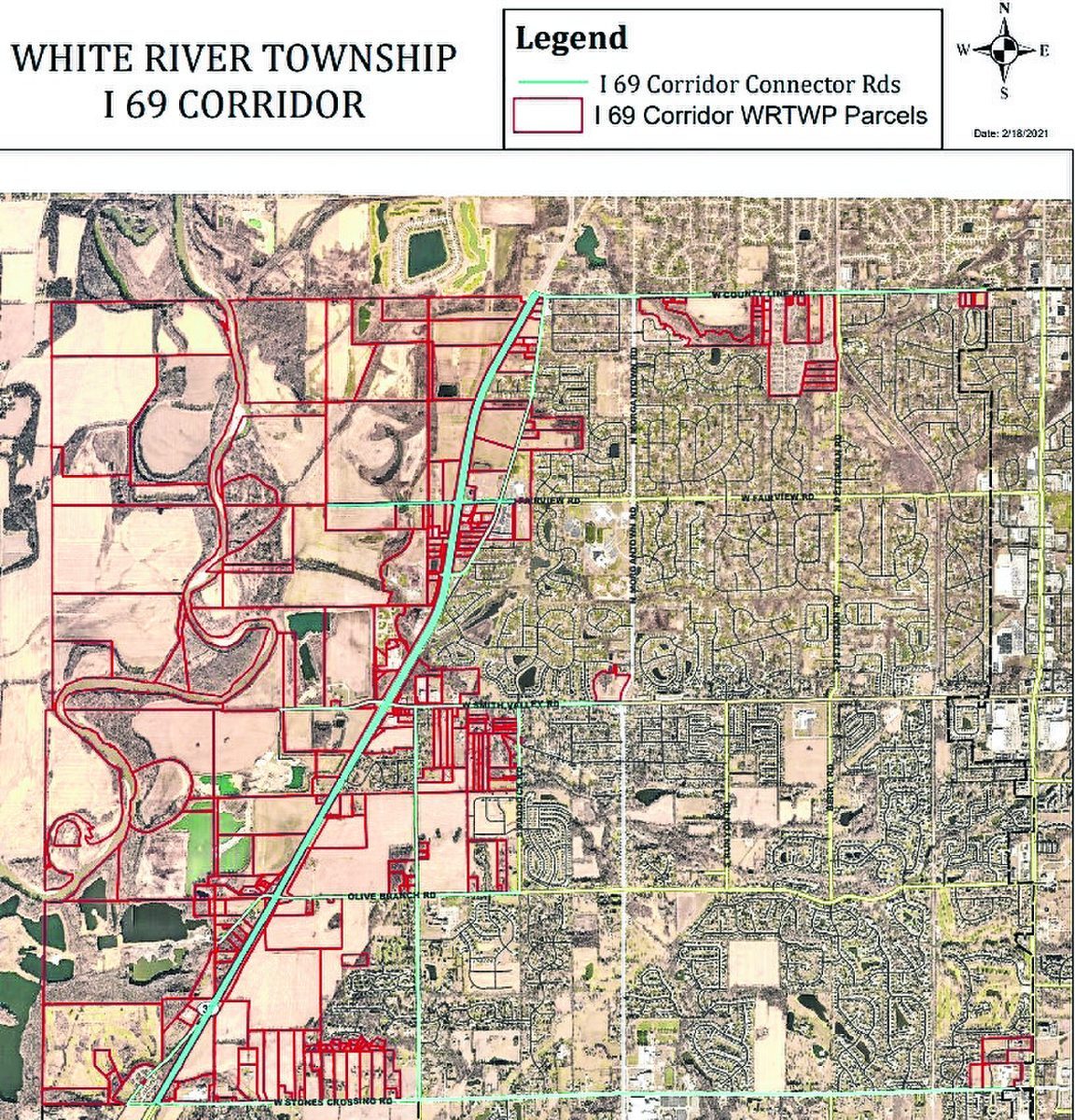

The TIF district is drawn around State Road 37, which will become I-69, and includes select parcels on roads that connect to it. Those roads are: Stones Crossing Road, Smith Valley Road, Olive Branch Road, Mullinix Road, Fairview Road and County Line Road.

TIF districts, also known as economic development areas, are created by local governments to spur growth and fund infrastructure improvements within a particular area.

Money collected in TIF districts is earmarked for future projects in the confines of that district, though money may be borrowed to use in another TIF district under certain circumstances.

The redevelopment commission would capture a portion of tax dollars from new structures built in the I-69 district, while some money will continue to flow to the county’s general fund, Center Grove schools and the Johnson County Public Library.

The district will exist for 25 years, following the issuance of the first bond with TIF dollars collected in the district.

Before the boards voted, several White River Township residents asked questions they say have gone unanswered by county officials.

About six residents attended the meeting, and three spoke during a public hearing.

Chris and Bonnie Meehan, who live on Stones Crossing Road in one of the parcels included in the district, had general questions about how TIF works and what new TIF revenue might pay for. They also wondered if the I-69 district passes the “but for” test that is outlined in state law. The law says TIF should be applied only to areas unlikely to develop without it.

“Do you think this is necessary? Wouldn’t the development happen with I-69 anyway?” Bonnie Meehan said. “With I-69, just due to the fact that it is there, this is probably going to happen.”

Redevelopment commission members were not on the same page about whether development would happen without the TIF district.

Commissioner Brian Baird suggested it would happen regardless, while Johnson County Council member Rob Henderson said the development may or may not happen, but the district is a tool to make sure the area develops.

“We hope that with this TIF and the potential benefit for tax-increment financing that we could make vision become more of a reality,” Henderson said.

Jeff Peters, a municipal consultant for the redevelopment commission, said the district passes the “but for” test because the area may not develop without a way to pay for the level of infrastructure developers look for when selecting a site.

“You may have to put forth a commitment to install sewers, water, roads, etc. in order to get this development to locate. Then you would use that money generated based on this new business location to service that debt,” Peters said.

There are no concrete plans regarding what exactly new TIF revenue will be spent on. A likely project is a sewer expansion, but the method of getting sewer to the area is not clear yet. Some possibilities are paying to have utilities extended from Greenwood, Bargersville or Morgan County, Henderson said.

Sewer was mentioned as a major barrier to growth by city and town officials who are opposed to an Interstate 65 TIF district that is still in limbo.

As a connection point between Indianapolis and Bloomington, local officials hope the area develops differently than Interstate 65, which is populated with warehouses and manufacturing facilities, Henderson said.

Aspire Johnson County intends to market the corridor for advanced manufacturing and technology sector jobs, with higher-end workforce housing and market-rate multi-family developments to cater to those workers.

A fiscal impact statement prepared for the district estimates the county could gain a $1.3 billion increase in assessed value, 37.1 million new square feet of business and commercial development, and more than 33,800 new jobs as a result of the TIF district. This is based on the type of development attracted to TIF areas in Franklin and Greenwood near I-65, U.S. 31 and State Road 135.

The Meehans were also concerned that their residential property is included in the area and what that means for the future of their property.

There are no plans to force residents who live in the district off their properties, or change their land-use category without their consent, Henderson said.

Future changes would be up to the owners and the market, he said.

“We suspect that I-69 will have an impact in that area of the county and maybe even throughout the county. What will it look like at your specific parcel or your neighbor’s parcel around there in 10 to 15 years from now, we don’t know,” Henderson said. “What we do know is this will put the process in place that allows the county to benefit from substantial changes in assessed value.”

White River Township Trustee Mark Messick is concerned the TIF district and future development will attract more residents to the area without leaving enough tax dollars for him to provide aid to the growing population, a responsibility of township offices, he said.

“I’m concerned we would not get the improved value for 25 years,” Messick said. “That would increase the amount of money needed to support the — for lack of a better word — poor residents of our township. We won’t be able to have those monies to take care of those new residents.”

Commissioner Ron West told Messick the trustee’s office would still get revenue from increased assessed value on residential properties.

The incremental increase the TIF district collects only applies to businesses and commercial properties, per state law. New residential property tax dollars would still flow to the same taxing units in White River Township.

Reallocating the increment while introducing growth would benefit Johnson County and White River Fire Protection District, but the township, library and schools would remain stagnant, a fiscal impact report shows.

The taxing units would not lose any existing tax revenue and could still gain tax revenue indirectly from a potential housing boom spurred by the district, the report says.