The Whiteland Town Council approved a nearly $4.1 tax break for an Ohio company to build a warehouse just east of the Graham and Whiteland roads intersection.

Uptown Commercial Partners, a Cincinnati-based real estate developer, plans to invest $3.8 million in the land and $25 million to build a 450,000-square-foot speculative building, according to town documents.

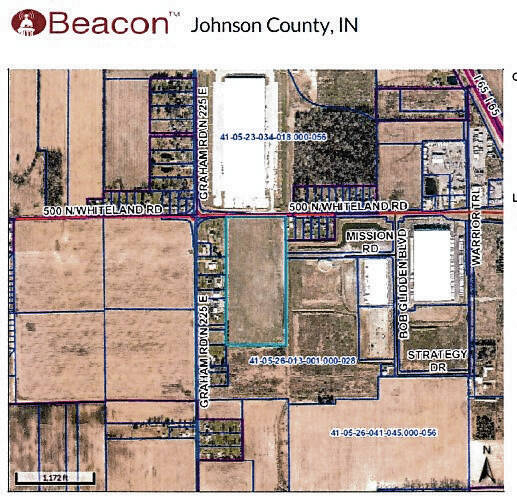

The 40-acre property is the former site of the Maschmeyer’s Nursery. It was rezoned to industrial from agriculture late last year, and was annexed into the town a decade ago, according to online property records.

Over the course of the 10-year tax abatement, $4.1 million in real property taxes will be abated, and nearly $3.9 million will be paid, according to a tax estimate. Without development, the land would generate about $11,500 in taxes during that time, the estimate shows.

The abatement is higher than those given to comparable developments by other cities.

For example, in August 2021, Franklin officials gave Peterson Property Group a 10-year, $3.5 million abatement for a $26.6 million speculative building of the same size. The company is expected to pay $9 million in taxes during the life of the abatement, according to a tax estimate.

In April 2021, Greenwood officials gave CA Industrial a 10-year, $2.1 million tax break for a $40 million investment in two speculative buildings sized at 278,000 and 429,000 square feet. The company is expected to pay $2.5 million in taxes over the 10-year period, according to a tax estimate.

No tenants are under contract, but the developer has several interested companies, said Eric Prime, a local attorney representing Uptown. It is unclear how many jobs the development will produce.

Construction is expected to start in May, with the building to be completed by next spring, according to town documents.

The eventual tenant would invest additional money to customize the interior of the building and purchase equipment or machinery needed to conduct their business at the site. An estimate provided in the abatement application suggests the investment could be about $10 million.