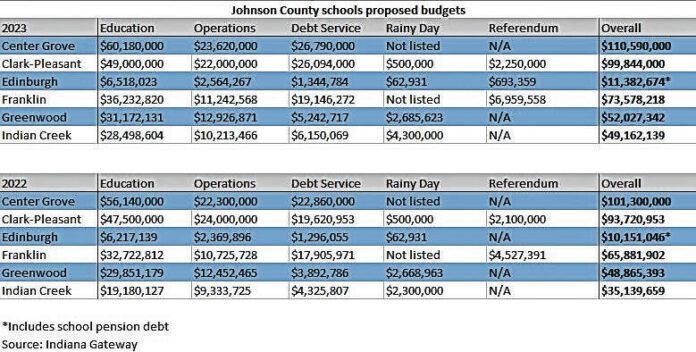

A look at proposed school budgets across Johnson County, with year-to-year comparisons.

Indiana Gateway data | Graphic by Andy Bell-Baltaci

With an increase in home values and additional students in Johnson County schools, local school districts will have more money to work with in 2023.

Center Grove Community School Corporation, with the largest student population of 9,434, likewise has the most money to work with, as school officials submitted a $110.6 million budget for approval by the Department of Local Government Finance. Edinburgh Community School Corporation, with just 879 students, will have a much more modest amount to work with, sending an $11.4 million budget to the DLGF for approval.

The figures come from Indiana Gateway, the state’s budget reporting website.

School boards approved the proposed budgets for Fiscal Year 2023 in October. The DLGF will review the budgets, make final adjustments and approve them in December. The DLGF always adjusts budgets downward, so schools will often propose a larger budget than they need, as the department can’t approve more money than what is asked for, said Tim Edsell, superintendent for Indian Creek schools.

Education fund

The six school districts divide money into four separate funds. The education fund mostly covers the salaries of teachers and other building-level employees, such as instructional assistants, principals and assistant principals. Money for the education fund comes from the state tuition formula, which awards schools funds based on how many students they have and other factors, including the percentage of those students receiving free and reduced-price lunch.

The proposed education budgets range from Edinburgh’s $6.5 million to Center Grove’s $60.2 million. The six school districts all have the education fund as the largest fund in their budget, taking up close to or more than half of the total amount, according to state data.

Indian Creek schools submitted a $28.5 million education fund, more than 50% greater than its $19.1 million proposal last year, although the approved figure will likely be far lower, perhaps around $17 million once the DLGF sends it back, Edsell said.

“For education, we have an increase where we’re making projections and trying to be competitive by increasing salaries for all our employee groups. We’ve had an increase in enrollment, but also because of special education services and mental health, that’s why we projected a higher amount in there,” he said.

Greenwood Community School Corporation, with a proposed $31.2 million education fund, boasts the highest starting teacher salaries at $48,014 a year. The school district’s proposed education budget increased slightly, from $29.9 million to $31.2 million despite the student population staying roughly the same, said Todd Pritchett, assistant superintendent.

“Even though our student number did not increase the dollar amount per students did,” he said. “We’ve added a few staff members based on class size in certain buildings. That’s the dollars we utilize for raises for teachers and support staff as well.”

Operations fund

Local property taxes fund both the operations and debt service fund, with increases in assessed home values increasing the amount brought in by schools. The majority of the operations budget covers salaries for district-level administrators, such as the superintendent, assistant superintendents and finance directors, as well as non-educational employees, including: bus drivers, food service workers and custodial staff. A portion of the operations budget also covers minor construction projects, such as spot repairs for cracks and leaks, and parking lot resurfacing, school officials for local districts said.

Proposed operations budgets ranged from $2.6 million at Edinburgh schools to $23.6 million at Center Grove schools. While five school districts increased their proposed operations budget from the 2022 to 2023 fiscal years, the fund at Clark-Pleasant Community School Corporation actually decreased, from $24 million to $22 million, according to state data.

New solar farms at Ray Crowe Elementary School and Clark-Pleasant Middle Schools are helping save the school district money officials would have spent from the operations fund on utilities. School bus purchases moved from operation to debt covered by the debt service fund, further decreasing the amount needed for operations, said Austin Fruits, finance director.

Debt service fund

The debt service fund is consists of debt from various major projects school leaders have decided need funding. These projects may include the construction of new school buildings or major renovation projects to add or replace classrooms at existing buildings. That debt is usually paid over decades, with school leaders replacing debt that’s been paid off with new debt in order not to raise the property tax rate.

Edinburgh schools have the least amount of debt listed at $1.3 million, while Center Grove schools have the most at $26.8 million, an increase of almost $4 million from last year. The extra debt is due to renovation projects at multiple schools, said Jason Taylor, Center Grove’s assistant superintendent.

“We’ve got additions going on at both middle schools to increase capacity, and we began early stages to expand the high school and Sugar Grove Elementary School,” Taylor said.

Additional funds

A fourth, and final fund for some school districts is the rainy day fund. The fund is money reserved for emergencies or unexpected expenses. Of the four districts that listed a rainy day fund in their budgets, Edinburgh schools had the least with $62,931, while Indian Creek schools had the most with $4.3 million, according to state data.

A fifth fund, the referendum fund, exists for three districts: Franklin Community School Corporation, Clark Pleasant schools and Edinburgh schools. Voters who live within those school districts’ boundaries approved property tax increases to fund various school improvements, such as teacher salary increases, school security measures and mental health services.

Clark-Pleasant and Franklin’s referendum budgets both increased due to rising home values. Clark-Pleasant, which had a referendum property tax increase of 10 cents for every $100 of assessed value for mental health services and school safety, including a school police department, had its fund increase from $2.1 million to $2.3 million.

Franklin schools, which had a referendum of 23 cents for every $100 of assessed value, will have almost $7 million to work within 2023 to increase teacher salaries and mental health services for students, compared to $4.5 million last year. The increased amount is due to a greater number of homes in the district, along with 18% higher assessed value since last year, said Tina Gross, the district’s chief financial officer.

“Like any other industry, we’re competing for teachers and labor force,” Gross said. “Pay raises help the effort to recruit and retain people.”

Edinburgh voters approved a referendum of 40 cents for every $100 in assessed value in May for teacher salary increases. That money will start going to the schools next year, and will amount to $693,359 in 2023, according to state data.