A house in the Oakville subdivision in Whiteland that was listed for sale in 2022.

Daily Journal file photo

Assessed values of homes skyrocketed in Johnson County last year, and that likely means residents can expect a high property tax bill this spring.

This trend of high AV growth has been seen statewide, largely because of the state of the hot housing market between 2020 and 2022 and general economic trends as a result of the COVID-19 pandemic, according to a recent study by Policy Analytics LLC for the Association of Indiana Counties, or AIC.

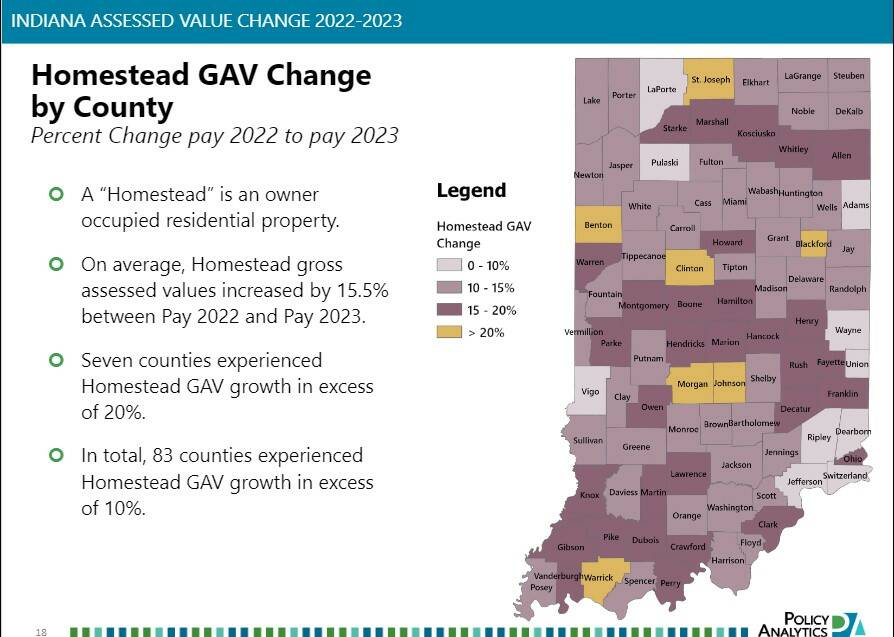

Total gross assessed value, or GAV, of all properties as of Jan. 1, 2022 — which is the assessed value date used for taxes paid in 2023 — increased by 13.2% statewide. In Johnson County, it was higher between 15 and 20%, according to the study.

Homestead assessed values in Johnson County grew exponentially by over 20% between pay 2022 and pay 2023 tax years. Johnson County was one of seven counties in the state to see the highest homestead GAV growth, according to the AIC study.

What’s in a tax bill?

The assessed value of all properties is calculated by the county assessor in each county. Increases and decreases in assessed values of residential real property, when factoring out new construction, are largely due to home sales and prices, said Mike Watkins, Johnson County assessor. Changes in cost of construction materials for new homes are also factored into formulas for calculating assessed value, he said.

The tax bills paid each year are two years behind the housing market. The 2022 assessed values, which reflect taxes to be paid in 2023, are calculated by the assessor’s office from 2021 house sale price data. The hot housing market between 2020 and 2022 is having a direct effect on property taxes being paid this year.

The median home price in Johnson County in January 2021 was $229,000, and it was up to $290,000 by December 2021, according to data from the MIBOR Realtor Association, the professional organization representing Central Indiana realtors. Homes also stayed on the market on average for less than 20 days in 2021.

Other tax bill factors

How much a residential property tax bill is each year is closely related to changes in the assessed value of the home, Watkins said. Other factors that may affect a tax bill include a property owner signing up for deductions they may qualify for and changes in the levy set by the various governing bodies in Johnson County.

Governments set a property tax levy as part of its budget process, and the levy is the revenue they intend to collect to pay for their government services, such as public safety and schools. The state also imposes a maximum levy local governments can collect to.

According to the AIC study, a local government’s tax rate is set by dividing its levy by its total net assessed value — which is the assessed value after deductions are accounted for on properties. That tax rate is multiplied by the net assessed value of each property, and the sum for all of them adds up to the levy each government needs for its budget.

Indiana also has a 1% property tax cap on homesteads, meaning a property owner does not pay more than 1% of their homestead’s gross assessed value each year, unless a tax referendum is passed locally.

Tax liability increasing

Total tax liability for all properties is also expected to rise significantly in Johnson County between pay 2022 and pay 2023, by over 12%, according to the AIC study. Homestead tax liability change is expected to increase by over 20% in Johnson County and in 24 other counties in Indiana.

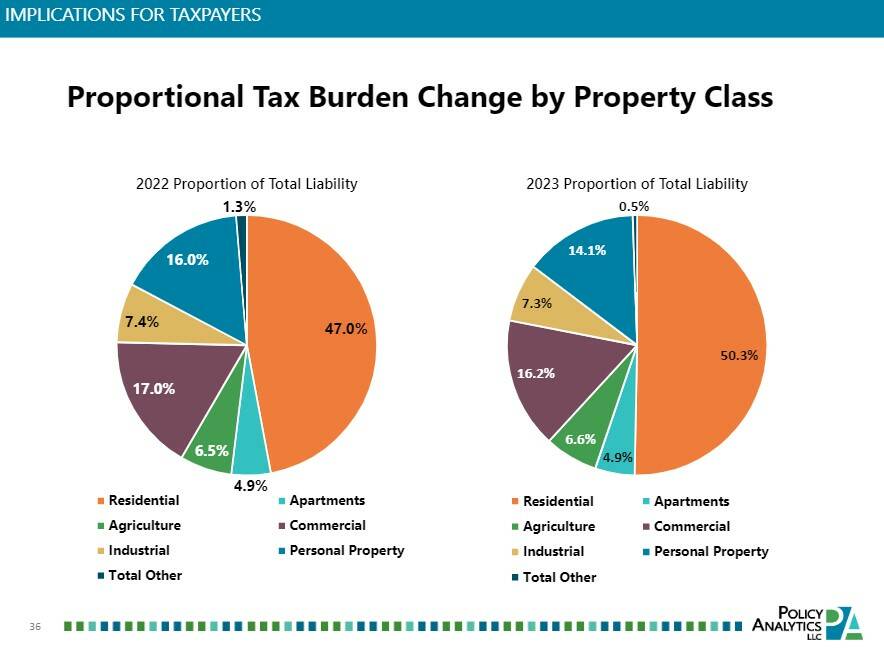

Property tax burdens are also shifting, adding more burden on residential properties, according to data in the AIC study. Residential properties made up 47% of the tax total liability in 2022, and are set to make up 50.3% this year.

Residents can calculate an estimation of how much their property tax bill will be this year through a property tax calculator in Indiana Gateway’s website. Bills can be calculated by entering a home’s assessed value and the resident’s taxing district, along with the deductions they receive.

For example, say a home in the city of Greenwood in Clark Township in the Clark-Pleasant school district is valued at $200,000. Generally, homeowners can apply for many deductions, including homestead deductions, supplemental homestead deductions and a deduction if they have a mortgage. After those deductions, taking into account the 1.932% tax rate and the .0773% property tax caps exemption rate, that home is expected to receive a maximum property tax bill of $2,076, according to the calculator.

State legislation to try to relieve high property taxes on homesteads is making its way through the Statehouse now, but it likely will have no effect on property taxes to be paid this year.

Relief on the way?

House Bill 1499, authored by House Ways and Means chair Rep. Jeff Thompson, R-Lizton, would make changes to homestead property tax caps and local government tax levies.

The bill, as it stands now after it passed committee this month, lowers tax caps at 0.95% for property taxes payable in 2024, and 0.975% in 2025. It also would increase the homeowner and renters deductions to $3,500 for residential property owners and $4,000 for renters.

The bill would also establish a process to decrease the rate of levy growth in 2024 and 2025. The proposal includes either a 50% decrease to the maximum levy growth quotient in 2024 and 25% in 2025, or a drop to 3% each year, according to a story from the Indiana Capital Chronicle.

Local levies statewide are expected to increase by about $779 million in the next year, according to the AIC study. Schools make up the biggest junk of that change, about 52.6%. Assessed value growth is also outpacing property tax revenue because tax base growth results in lower property tax rates, the study observes. Property tax rates fell in the last year in 95% of all taxing units in the state.

The property tax relief bill in the Statehouse has not yet passed the full House, as of Monday. If it does pass the House, it would still have to make its way through the Senate to become law. It has been met with opposition from local governments because of the potential local financial impact. Property taxes fund local governments and public schools, but not the state.

Local governments and schools could lose millions in revenue between fiscal years 2024 and 2026 under HB 1499, according to the latest fiscal analysis of the bill. Counties are projected lose over $141 million from 2024 to 2026, cities and towns $115 million and schools $180 million.

Watkins, though, said he is happy to see lawmakers trying to find relief for homeowners.

“I applaud Indiana lawmakers’ efforts to help Hoosiers negatively impacted by the changes we’ve seen in the economy for the last several years,” Watkins said.

As for the future of assessed value increases, that is largely unknown, Watkins said. The housing market is cooling down as demand for homes decreases, but home sale prices are still higher than they were two years ago. The median home price in Johnson County in January was over $289,000, and it hit $316,000 in December 2022.

“Assessments may go up, down, or stay the same in coming years,” Watkins said. “In the last year, the overall volume of property sales in Johnson County has decreased in comparison to the years prior, but sale prices are still trending higher than what they were pre-2020, and the assessments we’re seeing now are following the changes in the market.”