The second of up to 11 industrial buildings to be built on 542 acres east of Interstate 65 in Franklin is set in motion.

The Franklin Common Council voted unanimously to award Florida-based Sunbeam Development Corp. a tax abatement to build a 1.1 million square foot speculative building at Jim Black Road and Upper Shelbyville Road.

The tax abatement will save the company $13 million in taxes on the estimated $78 million building, while the company pays $12.9 million in taxes, according to a tax estimate compiled for the project. However, if this site were left as undeveloped farmland for the next 10 years, the city would only bring in $109,574 in taxes, said Dana Monson, Franklin’s community development specialist.

This will be the third speculative building Sunbeam has built in Franklin. Sunbeam also developed the building that houses Energizer and the building that will soon house a new Amazon Sorting Center.

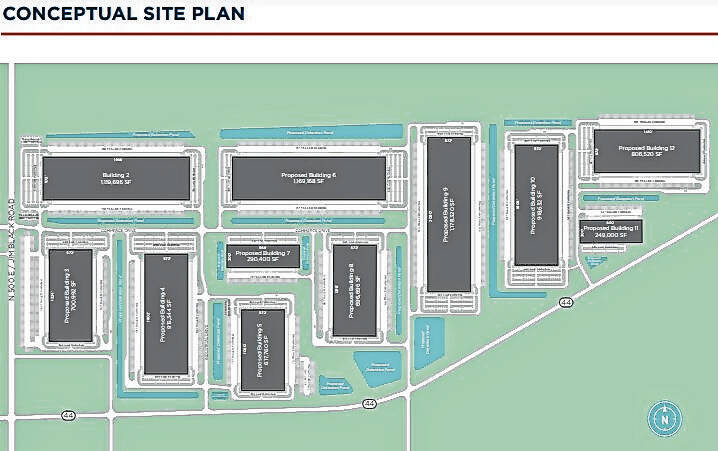

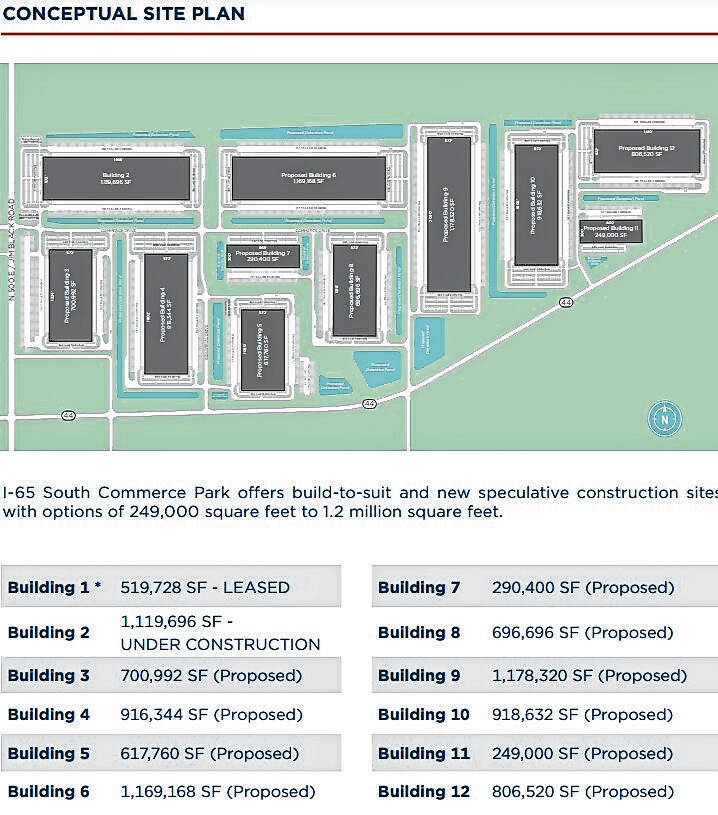

The Amazon building was the first to be built in a series of 12 across the 542 acres that Sunbeam has acquired that stretches from the northbound on-ramp of I-65 nearly to County Road 700 East on the north side of State Road 44. Most landowners on that side of the highway have sold to Sunbeam, with the exception of three, Beacon property records show.

Sunbeam is a family-owned company with over 60 years of experience developing properties in Florida and Indiana. The company has developed industrial, logistics and retail developments across the state in places including Fishers, Whitestown and Monrovia. A property in Shelbyville along Interstate 74 is also in development, said Justin Furr, Sunbeam’s director of construction.

Though the company builds speculatively, the community shouldn’t be concerned about the quality of the future tenants, he told the city council Monday.

“We are a speculative builder and I note that because it’s important that we control the quality of our buildings, as well as the tenants that operate in our buildings,” Furr said. “We’re extremely selective on their financial strength, their longevity, their ability to operate and not — you know — come in and start and stop.”

The company also doesn’t plan to sell the buildings and would maintain and manage them from Sunbeam’s office in Fishers. The company also employs an on-call maintenance person to handle any issues at the buildings outside of operating hours, he said.

“We hold on to these buildings for the long term,” Furr said. “To date, we haven’t sold any of these large buildings. We build them as an investment for the family.”

Site work is underway now through the acreage, including installing drainage and utilities. Doing this work ahead of building construction will allow the buildings to go up more quickly and consistently over time, Furr said.

Sunbeam officials have previously estimated it will take 10 to 15 years to fully develop the property, but Furr bumped up the expected timeline to five to seven years when he spoke to the council on Monday. The overall plan is to build or start about two buildings per year each year until it is built out, he said.

Over those years, Sunbeam plans to invest an additional $410 million to build 5.5 million square feet of new speculative building real estate. To date, Sunbeam has invested $90 million to build the Amazon building and purchase the 542 acres of land, he said.

Plans are also in process also for a building to be located on the southeast side of the property at Jim Black Road and State Road 44, where a farmhouse and several barns currently stand. The company could come back for a tax abatement on that property later this year or early 2024, Furr said.

Before additional buildings are constructed on the property, called Building 4 and 5 on the site plan, the company will raise the elevation of land that is currently in the floodplain. On property further east the developer will also relocate a gas line, he said.

Abatements are requested for these developments because of the amount of investment the developer puts into a site, Furr said.

“Without abatements, there’s an additional cost that we’re spending and taking on to develop this. Our competition, in frankly the entire state, has abatements on all of their large buildings as well,” Furr said. “So, when we go out to the market to compete effectively, without an abatement, it does put us at a disadvantage from a marketing standpoint.”

The current site plan shows two more buildings over one million square feet will be built, along with two buildings over 900,000 square feet and one over 800,000 square feet. The remaining buildings are expected to range from 700,992 square feet to 249,000 square feet.

Sunbeam has three other tax abatements. One abatement is for the building that houses Amazon and the other two abatements are for the construction and the build-out of the interior of the Energizer building.

The company’s history with the city is a major reason city officials felt confident moving forward with this abatement, said Shawn Taylor city council member and the council’s representative on Franklin Economic Development Commission.

“Sunbeam has been a really good partner for the city last few years with, you know, Energizer and bringing in Amazon. They have a vision for this whole plan,” Taylor said. “They’re spending a ton of their own money on the infrastructure with the pipeline and the roads … They’re not asking for us to pay for those things.”