U.S. Sen. Todd Young is pushing bipartisan legislation that could entice investors to revitalize blighted areas and bring in more affordable housing.

The Neighborhood Homes Investment Act, or NHIA, is co-authored by Young, a Republican, and Sen. Ben Cardin, D-Maryland. The bill would create a federal tax credit for investments into the development and renovation of single-family family housing in distressed urban, suburban, and rural neighborhoods.

“Around the state of Indiana, and really around the country, we’ve seen once vibrant neighborhoods struggle under poor economic conditions and a lack of investment,” Young said. “The housing affordability crisis impacts our families, really of all income levels in all geographies.”

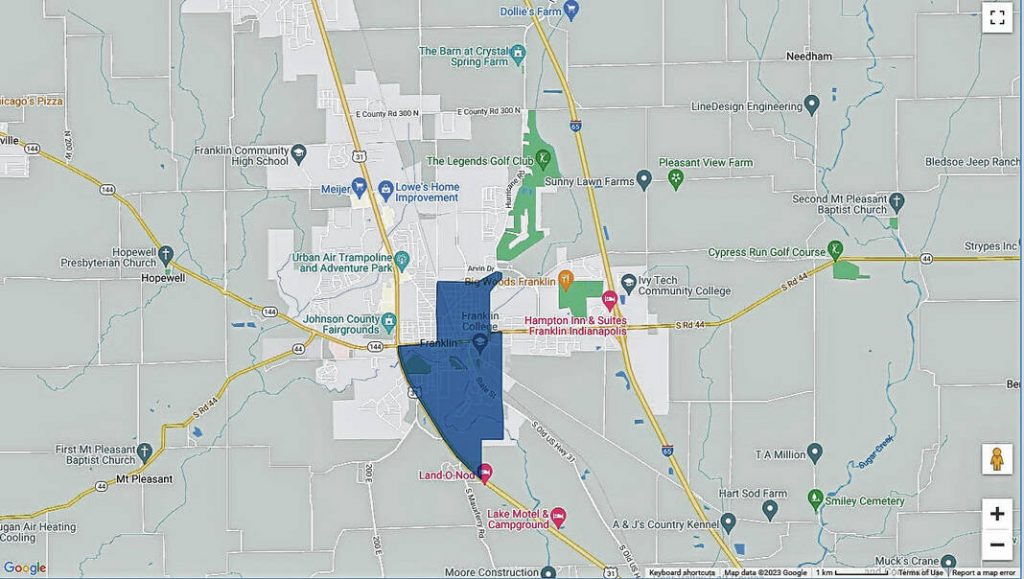

Several communities across the country could qualify for these credits, including part of Franklin, according to a map on the Neighborhood Homes Coalition website. The coalition, which is a third-party group separate from Congress, pulled together a map of potential communities that could qualify during the last Congress.

A section of older parts of Franklin east of U.S. 31 in the downtown area are marked out on the map as potentially qualifying for credits. Qualifying neighborhoods under the bill should have poverty rates that are 130% or greater than the metro or state rate and median incomes that are 80% or less than area median income.

Qualified areas listed by the Neighborhood Homes Coalition are from a previous version of the bill, so those could change as this current bill goes through the legislative process, a representative from Young’s office said. However, the map still gives a general idea of what areas could benefit.

Neighborhood revitalization can be stunted by what is referred to as the “value gap,” where the cost of rehabilitating or building a home is greater than the sale value of the home at the end, the Neighborhood Homes Coalition says.

The bill would specifically target areas of disrepair and blight where the cost of rehabbing a home isn’t worth the investment, Young said. That includes areas of towns or cities with abandoned houses or homes in disrepair.

“Almost every community has them. Where the homes are in significant structural and aesthetic disrepair,” Young said. “They are oftentimes unsafe, they can be repositories for gang activity, and other illegal activities like drug dealing and trafficking in some areas.”

The bill says it has the potential to generate 500,000 home rehabilitations over 10 years, $125 billion of total development activity, more than 800,000 jobs in construction and construction-related industries, and more than $35 billion in federal, state and local tax revenues.

Housing affordability and inventory is an issue Young has taken on since he’s been in the U.S. Senate. NHIA is one of many bills he’s authored to work on the problem. He’s also authored the Yes In My Backyard Act and the Affordable Housing Credit Improvement Act, neither of which have been passed into law due to Congress’s focus on other areas.

In Johnson County, housing inventory is on the rise, but builders say the central Indiana areas is still short thousands of homes to meet demand. The price tag on houses also continues to rise, with most new homes in Indiana starting at a price of $400,000. Many are getting priced out of the market.

NHIA will require that homes constructed or revitalized under the program must be sold to homeowners making less than 140% of the area median income. This ensures that improved housing directly benefits members of the communities targeted by the new tax credit, a press release from Young’s office says.

Young said this bill is a common sense way to address a problem because investors, not the government, bear the risk. Credits would be received only after rehabilitation is completed and the property is occupied by an eligible homeowner. The Treasury Department is required to provide an annual report on the performance of the program.

“As a Republican, we like to invite market solutions to deal with our nation’s challenges. And that’s exactly what we’ve figured out how to do with a Neighborhood Homes Investment Act,” Young said. “We have figured out how to unlock millions and millions of dollars of private capital that will increase the tax base and reduce the need for higher tax rates on other homeowners.”

Similar to the general idea of the NHIA, Franklin has taken on its own initiative to revitalize houses and commercial spaces around the older sections of the city. The Franklin Development Corporation offers revolving loans and grants that aid in restoring historic or underutilized homes and buildings within designated areas of historic Franklin, and those homes are later sold for a relatively affordable price. The corporation also has facade grants and loans for commercial space in historic areas.

The FDC has taken part in restoring four houses in Franklin so far, most of which had sat empty and in disrepair for years.

As for the NHIA, Young said he is optimistic about the bill moving forward this year or in the near future. It has been backed by several organizations including Habitat for Humanity, the National Association of Realtors, the National Housing Conference, the American Banking Association, the Homeownership Alliance and more.

The bill also has a partner legislation in the U.S. House of Representatives, which also has bipartisan support.