The Greenwood Redevelopment Commission approved creating a new tax allocation area in a bid to help keep construction costs down for an upcoming senior living neighborhood.

Commission members voted 5-0 Tuesday night to approve amending Greenwood’s Eastside Economic Development Area to create a new allocation area for an age-restricted senior housing development on the city’s far east side. The amendment also establishes an age-restricted housing program for the development under state law.

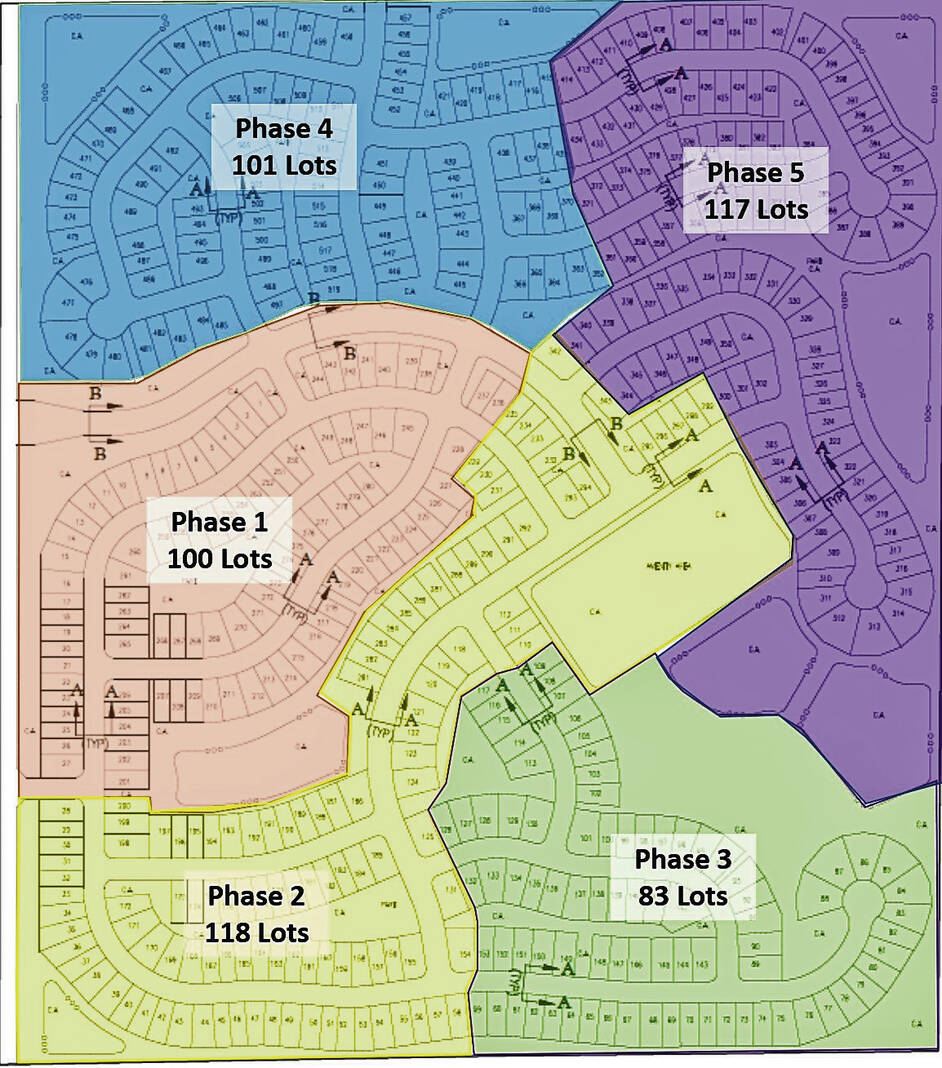

Pulte Homes of Indiana is developing a 55-and-up age-restricted single-family home development located east of Five Points Road and a half-mile south of County Line Road. About 185.97 acres of agricultural land were annexed into the city and rezoned for the project last year. The planned unit development, or PUD, would be a Del Webb active adult community of up to about 519 homes to be built in five phases, city documents show.

The development is planned to be “amenity-driven,” and Pulte Homes plans to spend $10-12 million on trails, pocket parks and landscaping. Since it is a neighborhood exclusive for older adults there will not be much additional strain on public resources, the developer told the city council in October 2022. This is because there will be no children, up to 60% fewer trips will be taken out of the neighborhood and there will be fewer new public safety calls.

The city’s RDC had previously approved project agreements showing their intent to reimburse the developer for utilities. The amendments approved Tuesday are the final conditions for the project agreements for the Del Webb community, said Adam Stone, a financial consultant for the city.

The economic development areas, or EDAs, capture tax dollars generated by property improvements. That means taxes on improvements to the property, such as newly built structures or redeveloped structures, go to the city’s RDC for projects within the district. However, the base property tax amount remains unchanged and continues to flow to entities that currently receive those tax dollars. The RDC uses funds generated by EDAs to complete projects or can issue tax incremental financing, or TIF, dollar-backed bonds to complete multi-million dollar projects.

The age-restricted allocation area for the Del Webb project is a first for not only Greenwood but for Johnson County. The move is allowed under Indiana law as there is a provision that allows for “for sale” residential taxes to be captured as part of incremental assessed value, Stone said.

Creating the new allocation area will benefit those 55 and up who want to build homes in the new development, he said.

“The idea is that ultimately this allows for the public infrastructure and site improvements to be, those costs to be lowered,” Stone said. “Therefore, the average sale price for those specific buyers (will) be more accommodating.”

Stone says the idea of the Pulte Homes development is to provide housing for a demographic that needs it. Once construction begins, the incremental taxes will flow to the RDC and then ultimately be used to repay and reimburse the utility improvements that were done pre-construction.

Although a new allocation area is technically being created, it will be part of the already-existing Eastside EDA. The taxes captured will eventually go to further economic development plans for the EDA, Stone said.

David Compton, vice president of land acquisitions for Pulte Homes of Indiana, later told the commission that “earth-moving activities” for the project will begin in April, with off-site sanitary sewer improvements beginning in January.