Greenwood city council members consented to create a new tax allocation area for an upcoming senior living neighborhood and approved an amendment to a speculative warehouse’s tax break.

The first resolution amends the city’s Eastside Economic Development Area to create a new allocation area for an age-restricted senior housing development on the city’s far east side; it also establishes an age-restricted housing program for the development under state law. The second amends a tax break given in 2021 for a GLA Properties, LLC speculative building on the city’s southeast side.

Both resolutions passed unanimously in a 9-0 vote Wednesday night.

Residential TIF

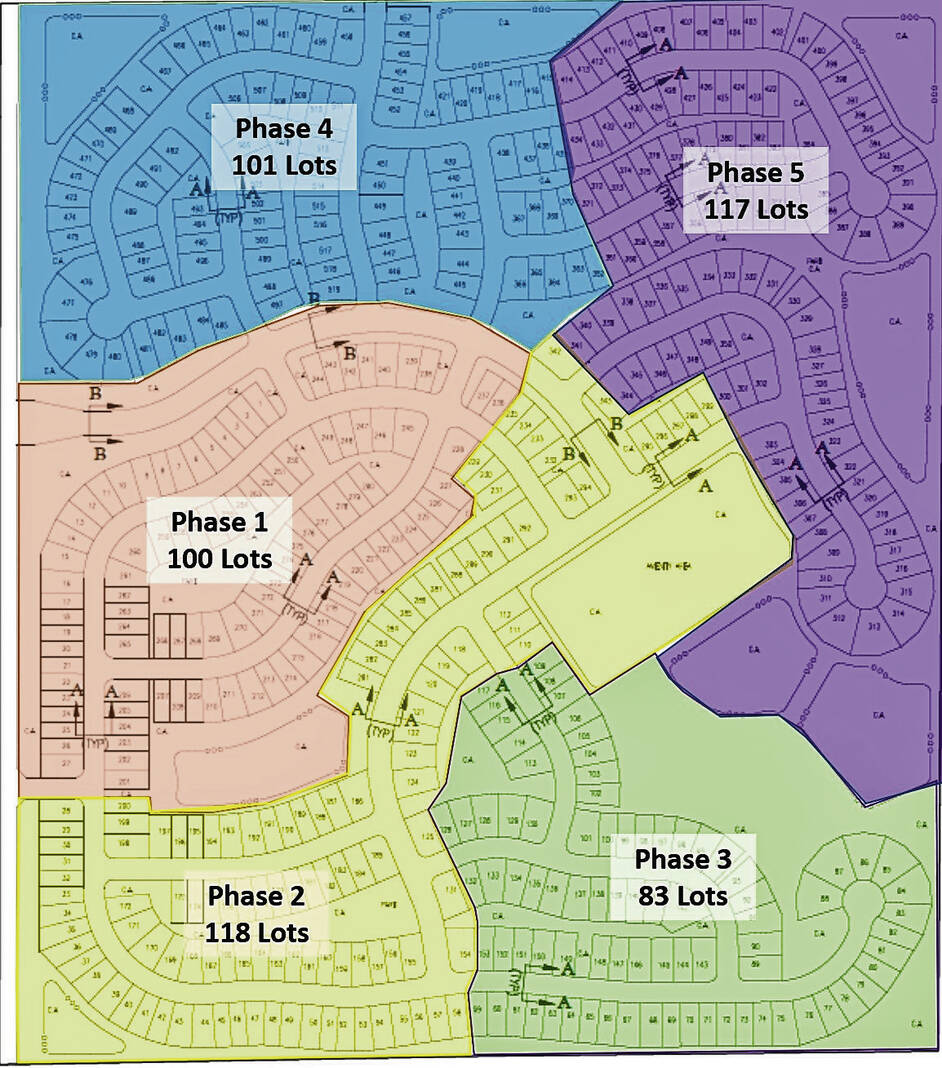

The residential TIF is for a Sagebriar, an upcoming 55-and-up age-restricted single-family Pulte Homes of Indiana development located east of Five Points Road and a half-mile south of County Line Road. About 185.97 acres of agricultural land were annexed into the city and rezoned for the project. The planned unit development, or PUD, would be a Del Webb active adult community of up to about 500 homes to be built in five phases, city documents show.

With the city council’s approval of the TIF, it now goes back to the RDC, which will have a final public hearing.

The Eastside Economic Development Area, or EDA, captures tax dollars generated by property improvements. That means taxes on improvements to the property, such as newly built structures or redeveloped structures, go to the city’s redevelopment commission for projects within the district. However, the base property tax amount remains unchanged and continues to flow to entities that currently receive those tax dollars. The RDC uses funds generated by EDAs to complete projects or can issue tax incremental financing, or TIF, dollar-backed bonds to complete multi-million dollar projects

The RDC and the city’s Board of Public Works and Safety entered into a private agreement with Pulte to participate and assist in infrastructure costs to develop the site. Tax increment financing, or TIF, revenues would be used as part of that participation, and the RDC resolution is a requirement to establish the new area, city financial consultant Adam Stone previously said.

The project is expected to cost the city $7 million and the commission would be reimbursed by Pulte for an amount up to $3.2 million, Stone said.

For this particular area, the city will be creating a “Housing Opportunity Allocation Area.” The project complies with the city’s comprehensive plan and had previously been before the plan commission when the land was rezoned in 2022, officials previously said.

In December, the city’s RDC approved the Eastside EDA amendment via a resolution. That resolution was the first of a four-step process to formally pass the amendment, Stone said.

The Greenwood Advisory Plan Commission approved the amendment last month, completing Step 2. Step 3 was the city council approving it.

The RDC will have final approval. The agenda for the next RDC meeting is not yet set.

Tax break amendment

As a result of a change of plans, a tax abatement for GLA Properties was amended Wednesday.

GLA was first approved for a $5.6 million tax abatement for a speculative 182,000-square-foot commercial building at an expected cost of $8.5 million in 2021. The building was Building 4 of their project within the Worthsville Commerce Center, located on the city’s southeast side.The speculative building was expected to be built on nine acres at the southeast corner of Collins Road and Allen Road, according to city documents.

Building 4 is now planned to be an approximately 89,527-square-foot building, expandable by an additional 27,780 square feet, officials say.

Although the plans represented a “significant reduction” in square footage, Scannell Properties Development Associate Justin Olashuk wrote in a letter to the city that increased pavement, utilities and other infrastructure costs would offset the decreased building costs.

Both GLA and Scannell Properties asked the city council to amend the tax break agreement so that it addressed the change in building size. They were not requesting any modifications to the $8.5 million investment from their initial abatement application, the letter shows.

GLA and Scannell first attempted to amend the abatement last fall, but the city council rejected the request in a unanimous vote on Oct. 16. Council member David Hopper took issue with the decrease in the building’s size, saying it would lead to a deduction of assessed value — which is what tax abatements are based on.

In January, GLA and Scannell represented the request with more information about the changes. With the revised Building 4, the estimated assessed value will be $12.55 million, according to a presentation from Alexis Sowder, director of client services for KSM Location Advisors.

Hopper said at the time he had doubts that the property would be assessed at the estimated value. He asked whether the developer could commit to the estimated value they gave.

After discussions with GLA and Scannell during a Feb. 5 city council meeting, the city council passed an amendment committing them to having a minimum assessed value of $12.5 million.