Scammers stole more than $37.8 million from older Hoosiers last year, according to an FBI report released Tuesday that shows a rise in losses through increasingly sophisticated criminal tactics.

Losses from scams reported by Hoosiers over the age of 60 were up 7.1% in 2023 compared to the year before, according to the elder fraud report prepared by the FBI’s Internet Crime Complaint Center. Nationally, scammers stole more than $3.4 billion from 101,068 Americans ages 60 and up.

With the latest report, investigators are warning of a rise in brazen schemes to drain bank accounts that involve sending couriers in person to collect cash or gold from victims.

In Indiana, the FBI received more than 1,255 complaints by victims of scams over the age of 60 last year. The state ranked 52nd out of the 57 U.S. states, districts and territories for reports over the age of 60.

The most commonly reported fraud among older Hoosiers tech support scams, in which criminals pose over the phone as technical or customer service representatives. There were 260 Hoosier victims ages 60 and up in 2023, the report shows.

In one such scam the FBI says is rising in popularity, criminals impersonate technology, banking and government officials to convince victims that foreign hackers have infiltrated their bank accounts and instruct them that to protect their money they should move it to a new account — one secretly controlled by the scammers. Tech support scams are up 3% nationwide but down about 6.5% in Indiana, while government impersonation scams are up 32% nationwide and up 31.6% in Indiana, compared to 2022.

Other most commonly reported frauds among older Hoosiers include confidence/romance scams, where scammers adopt a fake online identity to gain an individual’s affection or confidence and uses the illusion of a romantic or close relationship to manipulate and/or steal from an individual, and non-delivery/non-payment scams. For non-delivery scams, a payment is sent but good or services are either never received or are of lesser quality, while for non-payment scams, goods or services are shipped but payment is never rendered, according to the FBI.

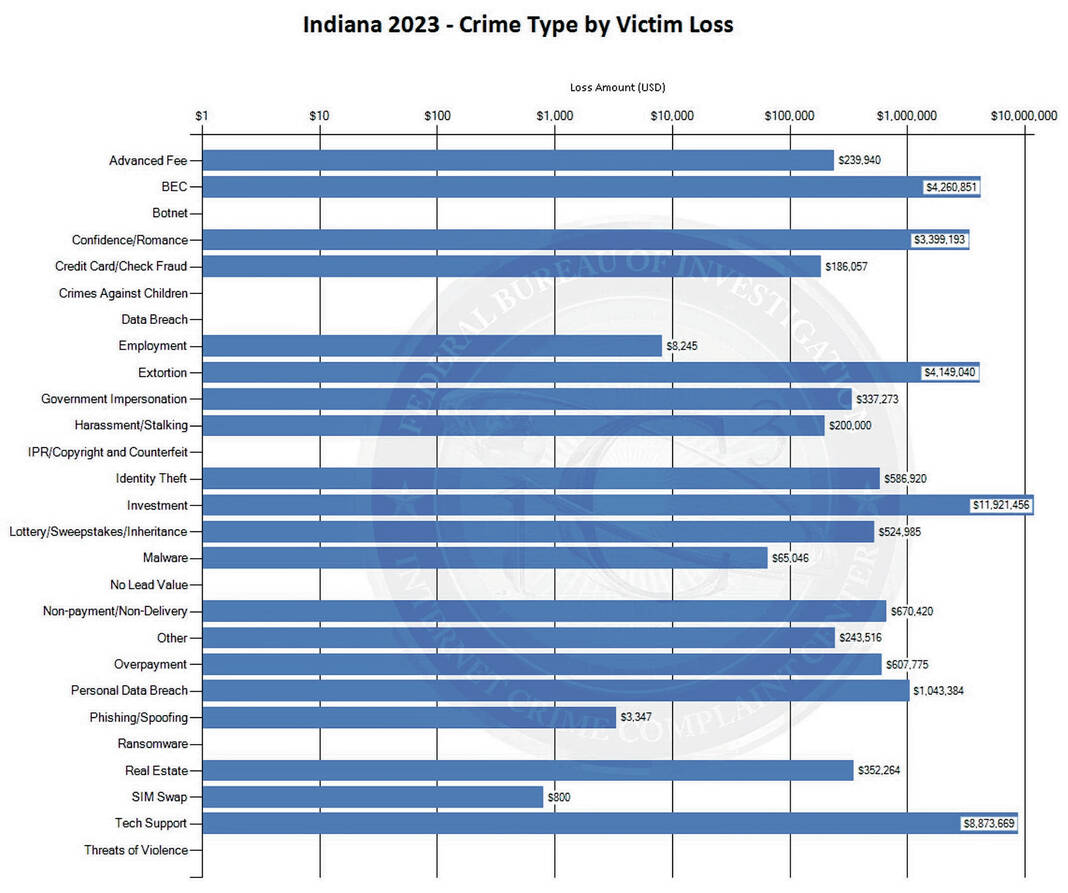

In terms of monetary value, older Hoosiers lost nearly $8.9 million to tech support scams. The FBI report also shows older Hoosiers lost about $3.4 million to confidence/romance scams and $670,420 to on-delivery/non-payment scams, the report shows. Investment scams led in victim losses, with $11.9 million in losses reported for 2023.

The FBI report also shows 218 older Hoosiers reported cryptocurrency or cryptocurrency wallets were used to facilitate the crime, with about $17.4 million moving through the mediums.

Story continues below

The staggering losses to older Americans are likely an undercount. Only about half of the more than 880,000 complaints reported to the FBI’s Internet Crime Compliance Center last year included information on the age of the victim, the Associated Press reported.

Locally, a Johnson County Sheriff’s Office detective who specializes in these types of crimes says he’s seen a variety of scams affecting the elderly. The detective isn’t being identified to protect ongoing investigations.

There are grandparent scams, where scammers find information about the victims and try to pose as a child or grandchild of theirs needing help, and caregiver scams, where a person pretends to have an interest in taking care of an elderly person when in reality they are conning them into having joint accounts, and slowly start stealing their money from them. There are Medicaid scams too, the detective said.

The detective has also seen scams affecting doctors and nurses of all ages. Scammers will call doctors pretending to be the Drug Enforcement Administration, telling them they need to pay to resolve an issue or else they’ll be arrested and taken to court. The victims will pay thinking they’re avoiding jail time, he said.

While not a scam specifically targeted at older people, the detective is concerned about the “butchered pig scam,” which involves cryptocurrency. He’s starting to see a trend where younger people are being targeted because scammers are changing tactics. These scammers will pose as authority figures to get people to respond to it, he said.

Organized crime tends to be behind all of these scams, the detective said. There are layers to the organization, which makes it hard to get to the perpetrator of the scam, he said.

These criminals often call from call centers. They recruit people with American-sounding voices in a bid to make it easier to convince people to pass over information and funds, the detective said.

The scammers are sometimes based in another country, where the sheriff’s office has no law enforcement authority, he said.

To avoid becoming a victim of these scams, the detective encourages people to ask questions and verify the information they are being told. If someone calls saying they’re from the FBI, ask for a number to call them back. Oftentimes the scammers are using burner phones where it is impossible to call them back, he said.

“The lottery doesn’t call you. The IRS doesn’t call to tell you to pay taxes, you typically get a letter and a notice to appear in federal court,” the detective said. “Just verify.”

Law enforcement is not going to stand for scammers stealing from the elderly — and using every bit of technology to do so, said Duane Burgess, Johnson County sheriff. The sheriff’s office has specially-trained detectives who are experts in these crimes, and they’ll use their expertise to lock the scammers up, he said.

“People have lost their life savings because of these people that prey on them,” Burgess said. “We’re gonna protect the elderly.”

The sheriff’s office will also continue to go out and educate people about the scams and what to do to avoid being scammed, he said.