Thousands of taxpayers received an unusual letter from the Johnson County Surveyor this month informing them of updated watershed assessment rates.

While the changes may come as a surprise to taxpayers, this is the third step in a years-long process to update the county’s decades-old watershed maps and assessment rates. The goal of the update is to modernize the county’s watersheds to better reflect current conditions, to ensure properties are being properly assessed for the water they drain and to ensure the drains can be properly maintained, said Gregg Cantwell, county surveyor.

Watershed update?

A watershed is an area of land that contributes, drains or “sheds” water into a specific body of water, like a creek or ditch. Every body of water has a watershed it receives water from, and watersheds drain rainfall and other stormwater events to swales, ponds, ditches streams or creeks. Watersheds can vary in size and include many ways to convey to water elsewhere, officials say.

In layman’s terms, a watershed is like the surface area of a home’s roof. The roof collects the water and sheds it down a gutter, with the gutter carrying the water away, Cantwell said.

“Sometimes, and that’s what we ran into when we redid it, a property will be just on the outside of the watershed, but it was easier for them to pipe that subdivision to a different watershed,” he said. “So maybe this creek was closer than this creek over here, so even though they were over here, they piped it this way. Well, that brings that subdivision into a new watershed.”

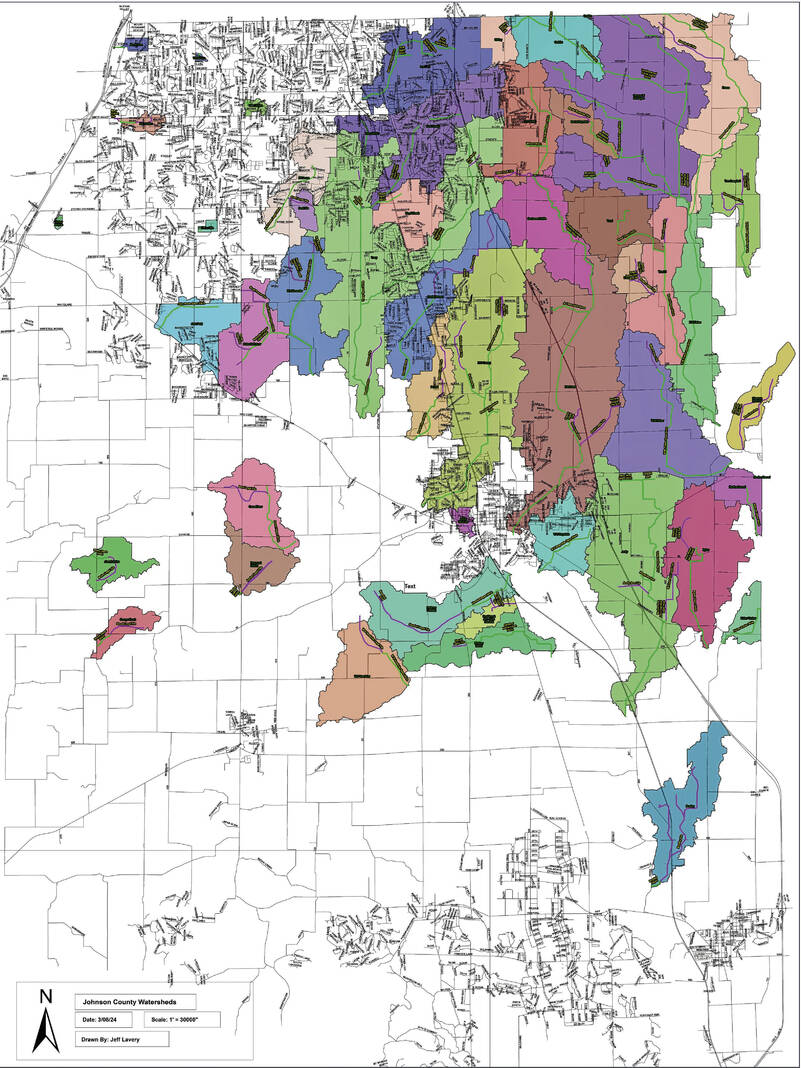

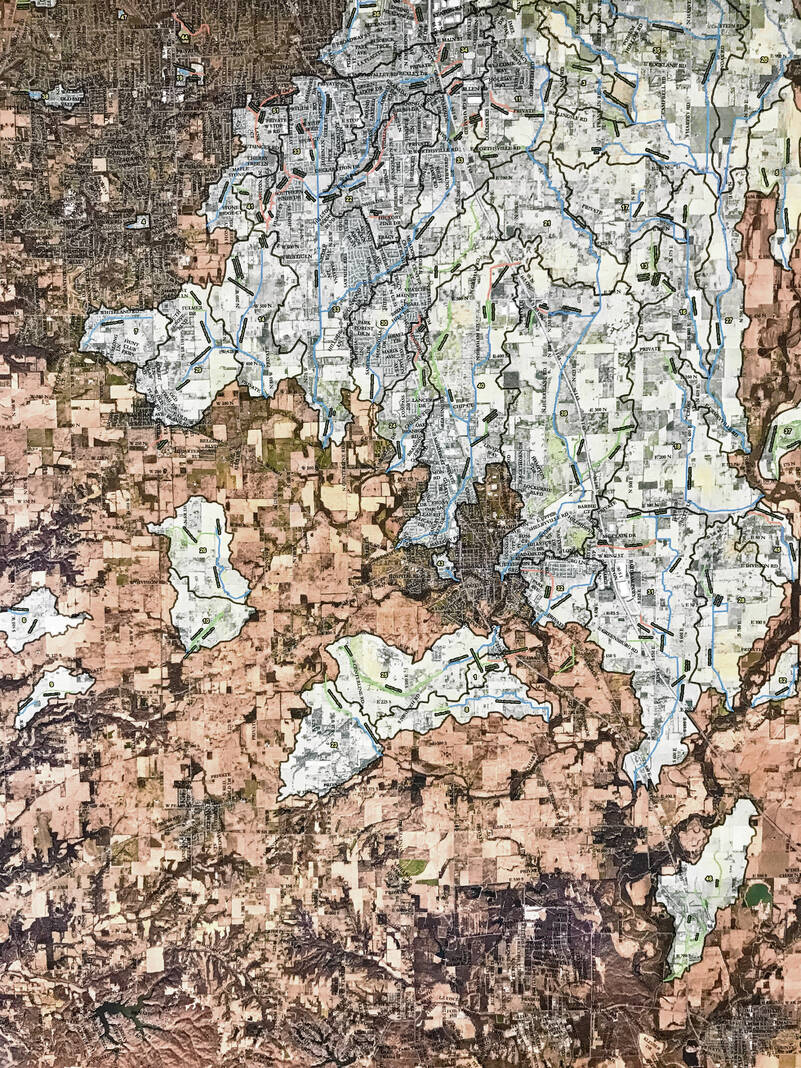

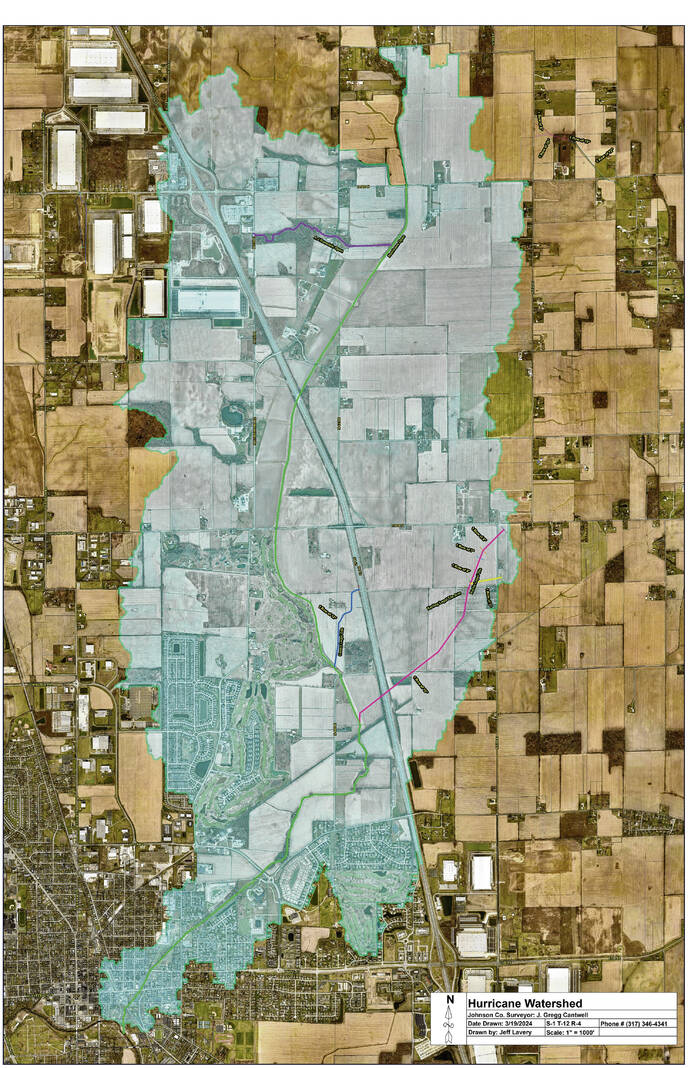

Johnson County has nearly 400 miles of regulated drains that serve 49 watersheds with a surface area of over 76,000 acres. These watersheds, which are maintained by the surveyor’s office per state law, are a combination of drainage ways, ponds, storm pipes, creeks, ditches and sub-surface tiles, officials said.

All properties that connect to a legal drain should pay an assessment fee for maintenance on the drain, but many currently do not because so much land has been developed since the last time the county surveyor’s office completed a full drainage assessment in the 1980s.

Additionally, many of the tiles and ditches date back to the county’s founding in 1823 when the east side of the county was described as a swamp. Early settlers dug the ditches and plowed the land and the ditches were designed for farming.

So in 2021, the surveyor’s office began the effort of updating the county’s watershed maps and assessments began. The maps and assessments for the most part have not been updated since the 1980s, Cantwell said.

This phase also included going from paper maps to digital maps, he said.

Following this first step, officials then began to reevaluate and study each of the legal drains to see what work would be needed and to establish a new schedule of assessment rates based on current costs for repair and whether the land is classified as urban or rural, officials said.

The current step, Phase 3, is to present the new assessment rates to the public for comment. This is what led to thousands of residents receiving a notice in the mail that their watershed assessment rates are changing.

Rate changes

The surveyor’s office sent out 31,000 reassessment notices to property taxpayers earlier this month, informing them of the watershed update, the watershed they are in, the new rates and why the changes were needed. So far at least 2,000 notices have come back as undeliverable, so the surveyor’s office will make another attempt to reach those property tax owners via a public notice in the Daily Journal before the June 22 hearing, Cantwell said.

Watershed assessment rates currently are assessed at a flat rate in each watershed, regardless of land use — agricultural, residential, commercial and industrial. A majority of the flat rates were in the $1 to $1.20 per acre category, though were a few newer watersheds based on modern numbers, Cantwell said.

When determining the new rates for property owners based on land use, officials first thought about how to divide it equitably among them. The most fair way would’ve been to look at each individual parcel to see how much water they shed off, but this would require hundreds more staff as there are 36,000 parcels, he said.

So instead, officials worked with the county assessor to divide it based on the land use categories — agricultural, commercial, industrial, residential and exempt, Cantwell said.

“Then we tried to balance knowing that the commercial and industrial were the ones that were producing the most runoff compared to the agriculture — that’s probably producing the least,” Cantwell said “So we tried to — instead of making it across the board — we tried to make it heavier for the heavy users.”

The assessments are specifically only for the maintenance of the regulated drains, meaning they can’t be used for buying equipment or vehicles, hiring new staff or paying salaries. It is strictly for hiring a contractor to do the work needed on the drain, he said.

Each of the county’s 49 watersheds has a fund for maintenance. Some fill up faster than others, Cantwell said.

Once a watershed’s fund is full, no additional watershed taxes are paid by property owners until some of the funds are used for maintenance. Funds from one watershed cannot be transferred to another, and the only way to refill a watershed’s fund once it is used is with the surveyor’s office’s general fund, Cantwell said.

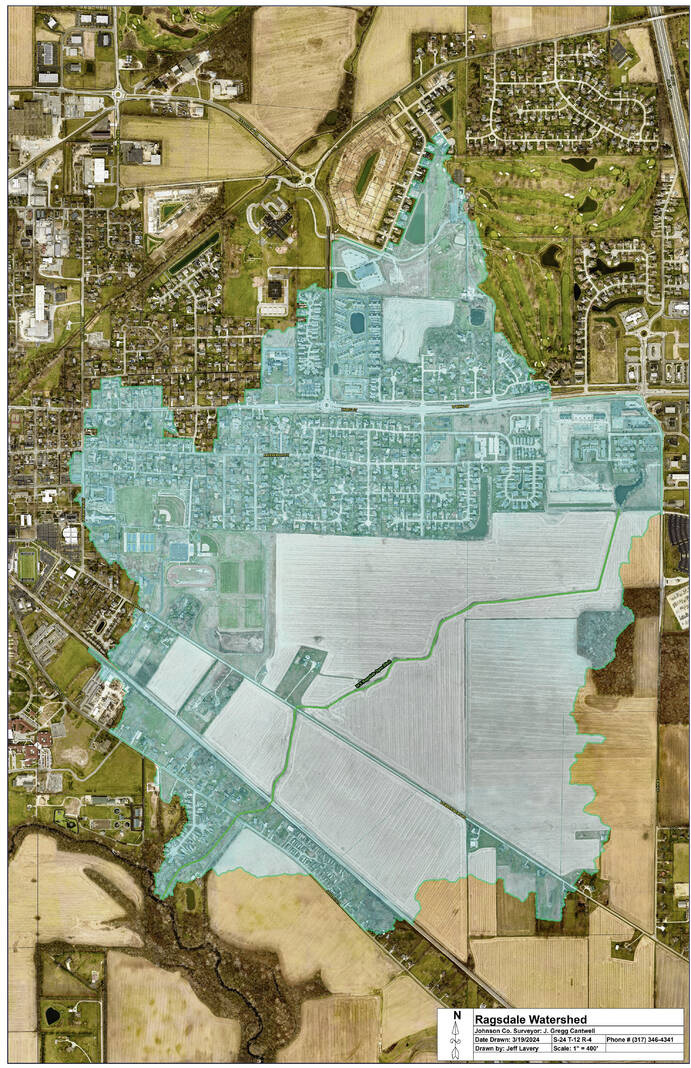

An example of the changes

The Canary Regulated Drain watershed, for example, is currently assessed annually at a rate of $27,779.16. The watershed, which stretches from northeast of Interstate 65 near Tracy Road southwest into Franklin and along Westview Drive, has a drainage area of 4,437.21 acres. Current land use along the legal drain includes primarily industrial and residential, with some commercial, mixed-use and agriculture use mixed in as well, according to county documents.

The balance in the maintenance fund is negative as of Dec. 18, 2023 — it stands at -$24,974.68. It’s negative due to maintenance work done on the ditch, and at the current rate, it will take less than a year of collections to pay off the debt owed. The current rate is a uniform $1.20 per acre or lot with a $10 minimum, county documents show.

This is only accounting for work that’s already been done. There are up to $4.5 million in future costs anticipated for maintenance of the legal drain. This is also on top of $406,823 of work that could be done now, county documents show.

However, with the proposed new assessment rates, it could be paid off much sooner — and then some.

The surveyor’s office is proposing four rates for the properties within the Canary watershed based on land use, whereas current rates are uniform:

- Agricultural — $5 per acre with a $5 minimum

- Residential — $10 per acre with a $25 minimum

- Commercial and Industrial — $200 per impervious surface with a $200 minimum

- Exempt (like governments) — $8 per acre with a $25 minimum

With these rates, the county could get $241,785.83 a year in assessments — a 770.4% increase compared to now. Impervious, or hard surfaces, include buildings, parking lots, sidewalks and more. The more hard surface a landowner has, the more water they shed into waterways, Cantwell said.

Hearings set

Along with informing property owners of the new rates, the notices sent by the surveyor’s office also give them a chance to comment and learn more in person.

A public hearing is for June 22, a Saturday, for residents to come learn more about the changes and to voice their concerns about their new rates. The hearing will be called to order at 9 a.m., but staff will be available at 8 a.m. to answer questions, Cantwell said.

There are four sets of hearings, with the watersheds divided among them. The meeting will take place at Herring Hall at the Johnson County Fairgrounds in Franklin.

Those who want to send written objections to the changes have until June 12, or 10 days before the hearing, to do so. These objections may have written evidence filed with them, county documents say.

The surveyor’s office can be reached by email at [email protected] or objections can be dropped off in person at the surveyor’s office, 86 W. Court St., Franklin.

Paying their fair share

Changing the rates across the county will ultimately ensure people are paying their fair share for what they shed into waterways, Cantwell said.

Many property owners do not realize they are paying a watershed assessment. On some property tax bills, it may be listed as one of the miscellaneous taxes under “other,” Cantwell said.

In other cases, property owners may not have paid into their watersheds fund for years because it’s full, he said.

“It just stays in there because it’s their money. We’re just holding it for the benefit of those people,” Cantwell said. “So it stays in there. And then when we spend money out of it, the math goes down and then that triggers it to reassess.”

Phases four and five are preliminary studies of the legal drains and their reconstruction. Costs for this were estimated at upwards of $301.9 million in 2022, county documents show.

In the end, the watershed update will ultimately lead the county in better shape for the future. For example, the maintenance work done on the drains will ultimately help prevent flooding by ensuring the drains can handle the water flowing through them, Cantwell said.

IF YOU GO

Watershed Reassessments Public Hearing

When: June 22

Where: Herring Hall, Johnson County Fairgrounds, 250 Fairground St., Franklin

Schedule

8 a.m. — Exhibits open (Staff available to answer questions)

9 a.m. — Hearing begins (Staff sworn-in; opening remarks; overview of reassessments schedule)

9:30 a.m.* — Group A Hearings (Watersheds: Brookstone, Cedar Hills, Floyd Sheek, Lee Park, L.W. Jones, Marry Sutton, R.A. Alexander, Scott Tile, Timber Heights, Tracy Greenwood, Villa Heights & Woodridge)

10 minute break

11 a.m.* — Group B Hearings (Watersheds: Banta Ragsdale, East Grassy, George Montague, Grubbs, Hurricane- Griffith, P.R. Griffith, Rouse, Shirley Tile, Tom Campbell, Trout & Trout II)

One hour lunch break

1:30 p.m.* — Group C Hearings (Watersheds: Amity, Bradley, Clarence Province, Daniel Brewer, Eades, E.M. Fisher, H.O. Canary, Hurricane, Martha Atwood, Ryker, W.M. Fisher & W.S. Ragsdale)

10 minute break

3 p.m.* — Group D Hearings (Watersheds: Addie Vandivier, Covert Deer, George Shuck, Herod, John Park, Joseph Boles, Matthew Hazelett, Powell, Raymond Norton, Robards Pruner, Southbrook, Tracy & W.S. Vandivier)

*Times approximate