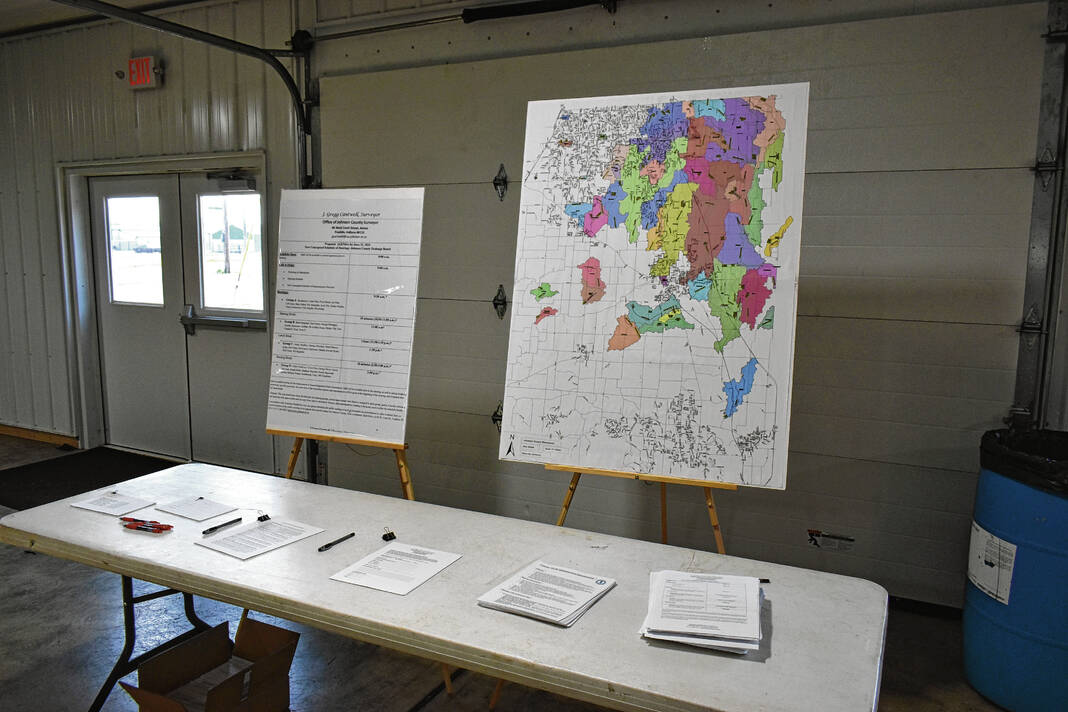

A Johnson County Surveyor’s Office employee shows a man a property on a watershed map Saturday at the Johnson County Fairgrounds in Franklin. Noah Crenshaw | Daily Journal

Thousands of Johnson County property owners will see new watershed assessment rates on tax bills next year.

The five-member Johnson County Drainage Board unanimously approved new rates for property owners and businesses within the county’s 47 of the 48 watersheds following public hearings Saturday at the Johnson County Fairgrounds in Franklin. Approval of rates for the Tracy Greenwood watershed was continued to a later date as board members wanted more information about accountability for how the funds were spent.

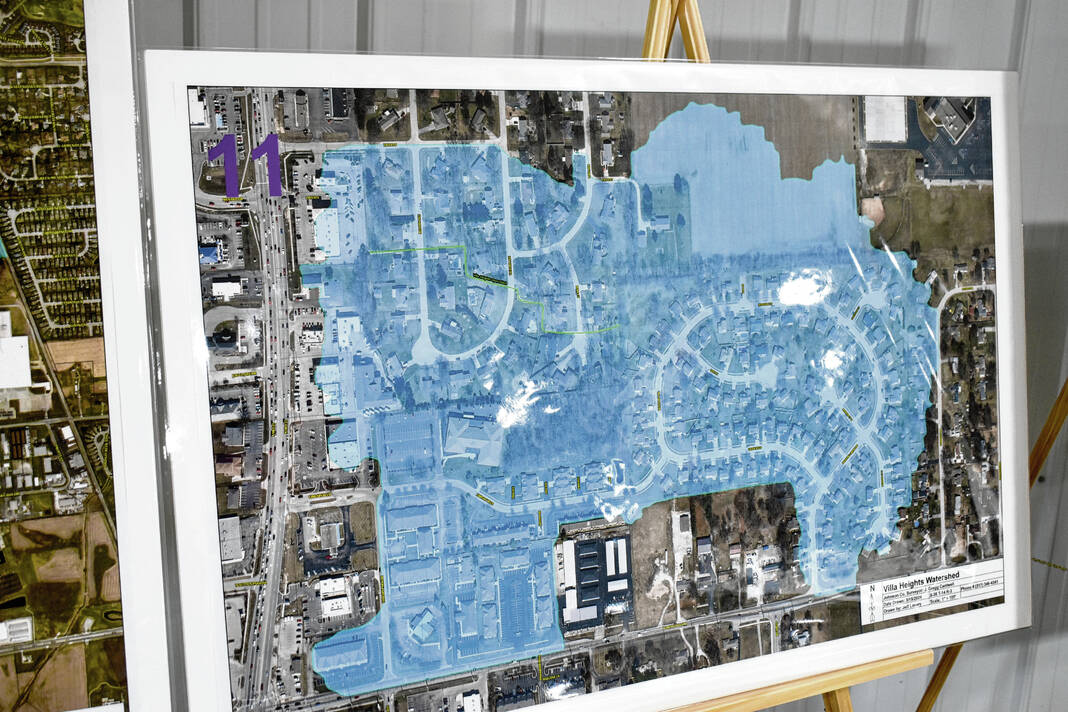

A watershed is an area of land that contributes, drains or “sheds” water into a specific body of water, like a creek or ditch. Every body of water has a watershed it receives water from, and watersheds drain rainfall and other stormwater events to swales, ponds, ditches streams or creeks. Watersheds can vary in size and include many ways to convey water elsewhere, officials say.

Johnson County has nearly 400 miles of regulated drains that serve 48 watersheds with a surface area of over 76,000 acres. These watersheds, which are maintained by the surveyor’s office per state law, are a combination of drainage ways, ponds, storm pipes, creeks, ditches and sub-surface tiles.

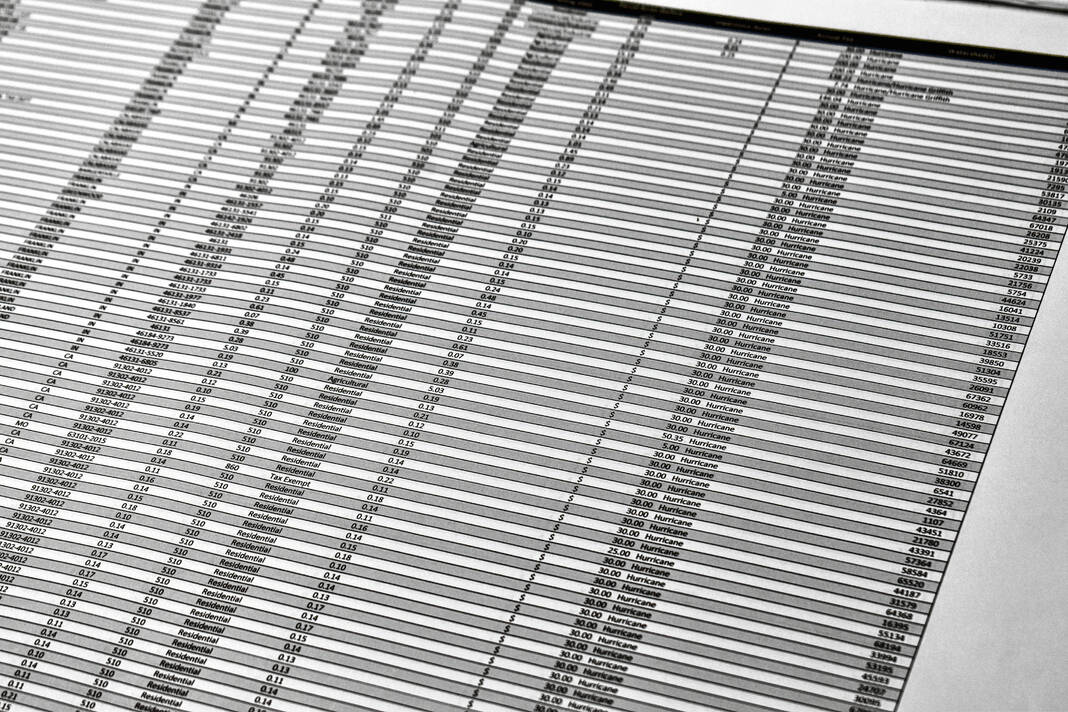

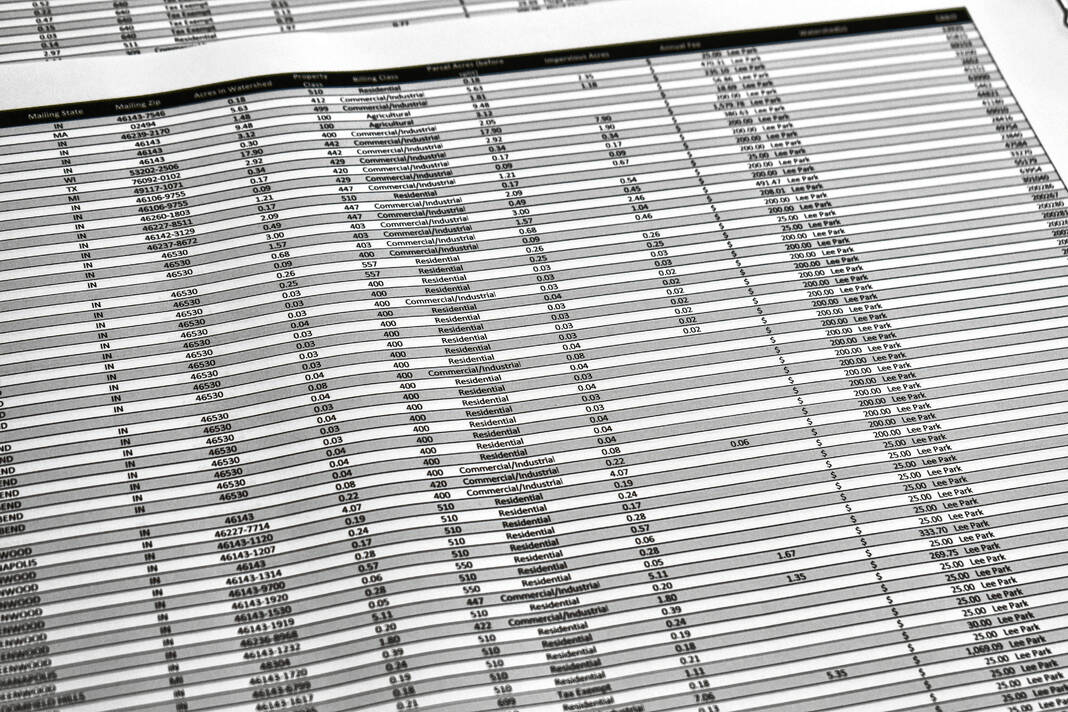

Saturday’s public hearings marked the completion of the third phase of the county’s years-long process to update the rates, which have not been updated in nearly 40 years. Watershed assessment rates currently are assessed at a flat rate in each watershed, regardless of land use — agricultural, residential, commercial and industrial. A majority of the flat rates were in the $1 to $1.20 per acre category, though were a few newer watersheds based on modern numbers, said Gregg Cantwell, county surveyor.

Many property owners do not realize they are paying a watershed assessment. On some property tax bills, it’s listed as one of the miscellaneous taxes under “other,” Cantwell said.

The first page of a property tax bill doesn’t list the watershed assessment rate, which is classified as other. However, the second page of the bill is more detailed and does list the watershed name and assessment amount. It can be found under Table 4 near the bottom of the statement.

In other cases, property owners may not have paid into their watersheds fund for years because the funds are full. Each of the county’s 49 watersheds has a fund for maintenance.

Once a watershed’s fund is full, no additional watershed taxes are paid by property owners until some of the funds are used for maintenance. Funds from one watershed cannot be transferred to another, and the only way to refill a watershed’s fund once it is used is with the surveyor’s office’s general fund, Cantwell said.

These fees are also separate from the stormwater fees charged by municipalities, which have full say over their own fees. The county does not, he said.

Why the update?

All properties that connect to a legal drain should pay an assessment fee for maintenance on the drain, but many currently do not because so much land has been developed since the last time the county surveyor’s office completed a full drainage assessment in the 1980s.

Additionally, many of the tiles and ditches date back to the county’s founding in 1823 when the east side of the county was described as a swamp. Early settlers dug the ditches and plowed the land and the ditches were designed for farming.

Many of these tiles and ditches need maintenance work that costs more than what their assessment funds have in the bank, Cantwell said. The assessments are specifically only for the maintenance of the regulated drains, meaning they can’t be used for buying equipment or vehicles, hiring new staff or paying salaries. It is strictly for hiring a contractor to do the work needed on the drain, he said.

Twenty-one of the 48 watersheds — nearly half — have negative balances. One watershed, the P.R. Griffith, which includes areas of Greenwood and Clark Township east of Interstate 65, is $229,667.07 in the negative, documents show.

With the need for an update so great, the Johnson County Surveyor’s Office began the effort of updating the county’s watershed maps and assessments began in 2021. The maps and assessments for the most part have not been updated since the 1980s, Cantwell said.

Following this first step, officials then began to reevaluate and study each of the legal drains to see what work would be needed and to establish a new schedule of assessment rates based on current costs for repair and whether the land is classified as urban or rural.

When determining the new rates for property owners based on land use, officials first thought about how to divide it equitably among them. The most fair way would’ve been to look at each parcel to see how much water they shed off, but this would require hundreds more staff as there are 36,000 parcels, Cantwell said.

So instead, officials worked with the county assessor to divide it based on the land use categories — agricultural, commercial, industrial, residential and exempt. They also worked to make it so heavier uses, like industrial and commercial, would bear more of the costs as they have more impervious surface areas, like parking lots, where water can’t drain as easily.

Concerns about impacts

Hundreds of residents stopped by the public hearings on Saturday, and many of the public comments were general questions about the process and why it was needed. Other comments from the public had more to do with concerns about how the new rates would impact their own properties or those of their neighbors.

Some residents also filed petitions provided by the surveyor’s office. The petitions are for property owners with questions about their reassessments or who want to be removed from a watershed to be heard before the drainage board.

The owner of the land occupied by the Pilot truck stop in Whiteland testified Saturday. He expressed concern about how his two parcels of land occupied by the station were being assessed in two different watersheds: the Hurricane and HO Canary.

A large part of this land is a retention pond, which he felt shouldn’t be assessed the same as a building, he said.

The assessments do not fit perfectly, and the case of the Pilot truck stop is an example of this, Cantwell said. This is why the petitions exist, and property owners can fill one out to talk to the surveyor’s office staff and drainage board about their situation more individually, he said.

Joe Wharton, a representative of Tipman Realty Partners, also took issue with the proposed assessment for the industrial building at 700 Bartram Parkway, Franklin. Their proposed Amity watershed rates would increase by 4,500%, from $239 to nearly $11,000. Wharton asked for it to be phased instead.

However, it can’t be because state law doesn’t give the board that leeway, said Roger Young, board attorney. Once the assessment is determined for the maintenance of the entire watershed, then 100% of the property must be assessed according to the fee schedules, Young said.

Whiteland resident Derek Foust was one of several residents who questioned the minimum assessment amount for residential property owners. He lives within the Daniel Brewer watershed, which has an assessment of $10 an acre with a minimum requirement of $25 a lot.

Cantwell reiterated the fairest way to do the assessments with the resources the county had was to spread it across all parcels, with commercial and industrial properties paying more as heavy users, he said. Additionally, if they were to assess all 36,000 parcels individually, they would require a substantially larger staff, Cantwell said.

“I would have the staff bigger than the sheriff’s department trying to figure out if you put field stones in your backyard last year because we’ve got to raise your rate,” he said. “It’s impossible to track all those moving parts, so there’s not a perfect example.”

Some residents also asked questions about how they could track the monies being assessed and where they could learn about surveyors’s office maintenance projects. Young and Cantwell said residents could find the budget and expense information online on the county’s website, co.johnson.in.us. The surveyor’s office would look into putting information on their county webpage about what projects they’re doing, Cantwell said.

As for how the monies are used now, because the county doesn’t have a lot of funds for preventative maintenance work, a lot of the time the surveyor’s office is doing emergency maintenance. The most common type of work is spring maintenance, which involves clearing brush from the legal drains, Cantwell said.

Near the end of the hearings, Greenwood resident Tom Webber complimented the board for taking action on what he said was an approaching crisis.

“It’s been heartwarming to hear these guys coming up with the solution, and it’s still gonna take a number of years to get us out of this, but we’re going to be going the right way,” Webber said.

Tracy Greenwood

Only one watershed did not have a decision on its rates rendered Saturday: Tracy Greenwood. This watershed is centered roughly in the area of U.S. 31 and Smith Valley Road in Greenwood.

Maintenance of the legal drain was turned over several years ago to the city of Greenwood. However, the county still does the assessment fee for it per state law. The funds are given to the city for the maintenance by the county, Cantwell said.

Members of the Johnson County Drainage Board were not aware of this, they said, because the decision to do this predated them. Johnson County Commissioner Kevin Walls, who is a member of the board, had questions about who was monitoring how much the city spent for maintenance of the drain and whether it was being fully spent for that purpose, he said.

The surveyor’s office did not immediately have an answer for this, so the board unanimously opted to table the decision for the rates for Tracy Greenwood until more information could be received by the board.

What’s next

The hearings went smoother than Cantwell expected, he said. He was expecting a much larger turnout, but turnout was still good, he said.

Surveyor’s office staff was also able to handle questions from the public, so some residents were able to share their thoughts without publicly testifying, he said.

With almost all of the reassessment rates approved, property taxpayers should expect to start paying the new rates with the spring assessments next year, Cantwell said. County officials will also meet to see if they could change how the property tax bills are designed so it shows property owners what watershed they’re paying into, board members said.

Once the funds are in hand next year, the surveyor’s office will move toward phases four and five, which are the preliminary studies of the legal drains and their reconstruction. This will help with fixing current drainage issues and improving them for future development. Costs for these phases were estimated at upwards of $301.9 million in 2022, county documents show.

Cantwell also encourages those with questions about the reassessment rates, or other drainage issues to reach out to the drainage board by calling 317-346-4341, or by filling out and turning in a petition. The form can be found at shorturl.at/zsvkm.

Editor’s note: This story was updated at 12:12 p.m. June 26 with clarifying information provided to the Daily Journal about where watershed assessment rates appear on property tax bills.