Amid a rise in scams targeting seniors, local and state officials are offering tips on how to avoid them.

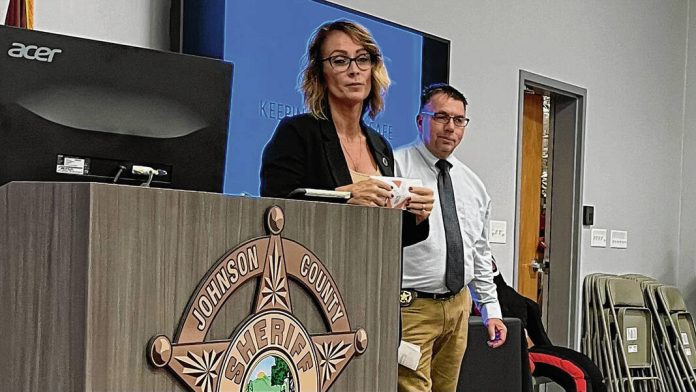

The Johnson County Sheriff’s Office joined forces with the Indiana Attorney General’s Office for a senior scam and fraud education presentation Wednesday at the sheriff office’s training center in Franklin. Over the course of about two hours, officials told seniors, representatives of local senior living facilities and other stakeholders about what they’ve seen, red flags and how to report fraud and scams.

In 2022, the sheriff’s office worked 59 cases involving senior fraud and scams. So far this year, they’ve worked 62 — a nearly 5% increase, data shows.

“We’ve seen a rise in these cases locally and nationally,” said Maj. Damian Katt, investigation commander. “Not only has the number of cases risen, but the monetary value of these losses has increased dramatically — sometimes life-changing for some of these people.”

Scammers target seniors more often than not because they need to target someone with money. Young adults typically have more debt, making them not as good a target as more established seniors, said Detective James Bryant.

Seniors also tend to be more trusting, as they grew up in a time when people were taken at their word.

“This is how they were raised,” Bryant said. “If someone said they needed money, family often gave them money if they had money to give. They were taught to help people if they needed help.”

This sense of trust also applies to the internet, Bryant said. Seniors are more likely to click on suspicious links or open emails from someone pretending to be something else.

“The senior citizen may give personal information or money to someone impersonating someone online, or worse a potential love interest,” Bryant said.

Phone numbers belonging to legitimate places, such as the sheriff’s office, banks or government offices, are increasingly mimicked by scammers to try to get people to give them personal information as well.

Current trends show an increase in romance and overpayment scams, along with counterfeit and fake checks. Last year, romance scams cost victims $1.3 billion, and almost 70,000 people reported being victims of these crimes, Bryant said, citing numbers from the Federal Trade Commission.

The median reported loss was $4,000, he said.

For romance scams, the scammer’s intention is to establish a relationship as quickly as possible with the victim to gain trust. This often takes place online on social media, where it’s very easy for criminals to find victims.

It’s easier for seniors to fall for these scams because they are from a generation where all people are assumed to be good until proven otherwise, Bryant said.

“Today’s technology, combined with easy access to social media, creates a perfect storm,” he said.

The scammer may propose marriage and make plans to meet in person, but that never happens. Eventually, they’ll ask the victim for money, Bryant said.

Oftentimes, the victims and the scammers could text or talk for weeks, months and years without ever speaking in person. The result is the loss of thousands of dollars — a loss that is sometimes never reported because seniors may feel embarrassed, he said.

Overpayment scams are when a scammer comes up with a reason to overpay on a bill or invoice using a check or electronic payment. In these cases, someone pays too much money and they want the extra money back to be paid to a third party. The check could be deposited and clear the bank but it’s not until later it is determined it’s from a counterfeit check.

Paper check scams involve counterfeit or stolen checks, and oftentimes the original owner may not know their account is compromised. It’s not complicated to make or duplicate counterfeit checks, Bryant said.

“The biggest risk of using paper checks is they contain bank account number and routing number, as well as your physical address — which is important,” he said. “Remember that sensitive information can be exploited if a personal check falls in the wrong hands.”

Counterfeit checks are often printed with the names and addresses of legitimate financial institutions. They could even be real checks belonging to someone whose identity has been stolen, Bryant said.

Additionally, people should not leave their checks in mailboxes. If someone puts up a mailbox flag, it tells scammers there might be a check in there. They could open the letter, take out the check, take a photo of it and reseal the envelope like nothing’s happened, he said.

They can use the photo to print checks with your routing and account number, and use your address to find your house and estimate your income, he said.

“That’s why counterfeit checks are hot. They’re the hottest right now that they’ve ever been,” Bryant said.

Leaving checks in blue U.S. Postal Service boxes also carries some risk, as there’s been an increase in mail carrier robberies. Bryant encourages people to consider using alternative ways to pay, such as Zelle, PayPal, Venmo or using online bill payment services through their banks. These services have consumer protections, he said.

Fraud crimes like the scams seniors face tend to have lower solvability and recovery rates, as oftentimes the perpetrators are not in the same state or country which can make it difficult for arrests and recovering the funds. It’s still important to report the crimes because there’s a chance law enforcement can mitigate the damage, and even get some of the money back, Bryant said.

The Indiana Attorney General’s office has a team of investigators who can track the scammers as well, even overseas, and often work with law enforcement. Though they are not able to get them all, officials are able to get a win and get some money back, said Kim Harris, outreach representative for attorney general’s office.

Once one scam is taken down, another one always pops up, Harris said. It is challenging for officials to keep up as technology continues to change, but they will continue to help seniors as the technology evolves, she said.

If a senior or someone who knows them suspects they are being scammed, they should tell someone they trust and report it to Adult Protective Services. They should also contact local law enforcement, Bryant said.

SIGNS OF A SCAM

There are four signs that people can look out for to determine if something is a scam:

- Scammers pretend to be from an organization you know: They could use a real name, like the IRS, and change the caller ID to reflect it.

- Scammers say there’s a problem or a prize: Some could say you’re in trouble with the government, others could say you won money in a sweepstakes but have to pay a fee to get it.

- Scammers pressure you to act immediately: They want you to act before you think, and may tell you to not hang-up so you can’t check their story.

- Scammers tell you to pay in a specific way: They may ask you to pay using cryptocurrency, gift cards or by wiring money through MoneyGram or Western Union. Some may send a fake check, telling you to deposit it and send them money.

Source: Federal Trade Commission

HOW TO AVOID SCAMS

There are several ways people can avoid being scammed:

- Block unwanted calls and text messages.

- Don’t give personal or financial information in response to a request you didn’t expect.

- Resist the pressure to act immediately.

- Know how scammers will tell you to pay.

- Stop and talk to someone you trust.

- If you were scammed, or think you saw a scam, report it to local law enforcement and to the FTC at reportfraud.ftc.gov.

- If you want to freeze your credit or social security number, you can go to IN.gov/attorneygeneral and search for “Credit Freeze” to find more information.

Source: Federal Trade Commission, Indiana Attorney General’s Office