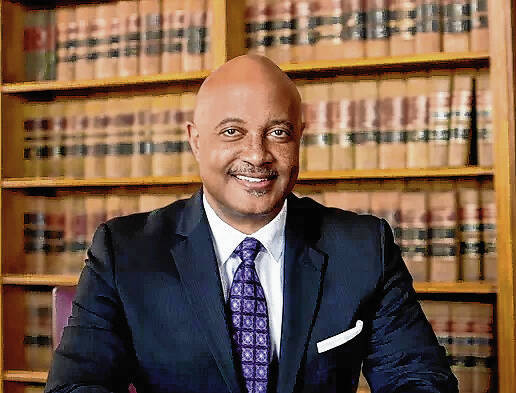

Indiana Republican gubernatorial candidate Curtis Hill has proposed massive tax changes if he’s elected.

Former Attorney General Curtis Hill released a six-point economic plan Wednesday that slashes several taxes — gas taxes, corporate tax rates, income taxes and sales taxes. Hill is one of five Republicans running in the May primary to succeed Gov. Eric Holcomb, who is term-limited.

In addition to Hill, U.S. Sen. Mike Braun, Lt. Gov. Suzanne Crouch, Fort Wayne businessman Eric Doden and former Indiana Secretary of Commerce Brad Chambers are seeking the Republican nomination. The winner will likely face former Superintendent of Education Jennifer McCormick, formerly a Republican but is running as a Democrat, and Libertarian Donald Rainwater, who made Indiana history when he received over 10% of the vote in the 2020 election.

Hill’s economic plan, dubbed “Indiana’s Pathway to Prosperity,” addresses gas taxes, corporate tax rates, income taxes and sales taxes. It also eliminates the income tax for young earners between the ages of 18 and 35, along with seniors, the latter of which would also benefit from a 3% cap on sales taxes, the plan shows.

But it does not go as far as Crouch’s call to completely “axe” the state’s income tax for all Hoosiers.

Hill’s plan calls on reducing Indiana’s gas use tax by 16 cents, which Hill says would cost the state $230 million in revenue. His proposal says this would encourage investment and expansion of commerce companies while helping the average Hoosier.

His plan also calls for lowering the trigger percentage for the state’s automatic taxpayer refund from 12.5% to 10% of the state’s reserves. Hill says by lowering the threshold, the likelihood is increased that Hoosiers will receive additional tax refunds, which can help stimulate our economy and make it easier for Hoosiers to buy gas, pay for groceries, or stock up on school supplies.

Other highlights of the plan include:

- Cutting the state’s corporate tax rate from 4.9% to 3.5%, making it one of the lowest in the nation. Hill’s proposal says this would encourage new businesses to invest in Indiana, bringing new jobs, better opportunities and a larger tax base to “accommodate such a cut without hurting the fiscal stability of our state.”

- Implementing zero-based budgeting for state agencies. Hill says this would “address wasteful government spending” to offset proposed cuts.

- Eliminating young earners’ income tax for Hoosiers between ages 18 and 35.

- Reducing sales taxes to 3% for seniors and eliminating the retirement income tax.

According to the Indiana Capital Chronicle, Hill’s team did not provide estimates for what the proposals would cost or suggest cuts to services impacted by the decreased revenue. In a statement to the outlet, Hill said the plan makes “marginal cuts that will ease the burden on Hoosier taxpayers” that would, in turn, boost the state’s economy while encouraging economic growth and investment and encouraging Hoosiers to live, work and retire here.