A 40-acre, $10.6 million sports complex at the Worthsville Road interchange is up for funding discussion.

Greenwood’s city council is considering tax increment financing (TIF) funds to pay for construction of a sports complex on the city’s southeast side.

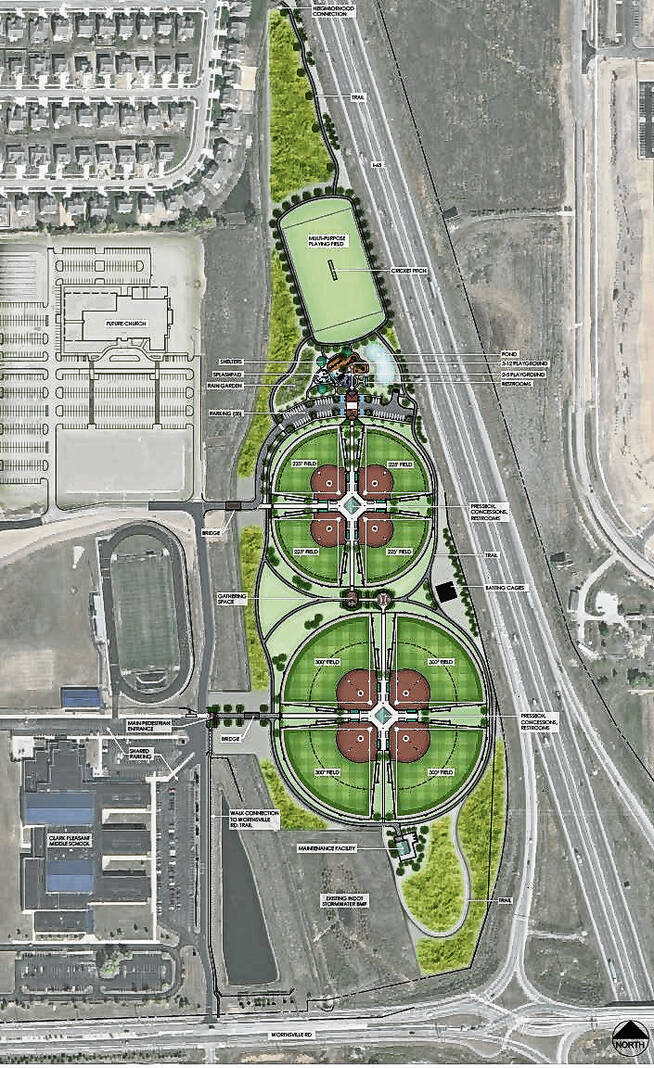

Last year, city officials announced their intent to build the complex on a piece of property near the Interstate 65 and Worthsville Road interchange, adjacent to Clark-Pleasant Middle School, Ray Crowe Elementary School and Redeemer Bible Church. The complex would include four softball diamonds, four baseball diamonds and a multi-use playing field. It will also include the city’s second splash pad, and add to Greenwood’s inventory of inclusive playground equipment, according to designs for the project.

The complex will also provide a new local place to play for traveling sports teams and their families, Mayor Mark Myers said last year.

At the time officials said the price tag on the complex wasn’t final, but the hope was to keep it under $10 million. Officials also said they planned to use tax-increment financing (TIF) dollars and park impact fees to pay for part of the project, along with applying for state or federal grants, city controller Greg Wright said last year.

During Monday’s council meeting, Wright came forward to request the issuance of a TIF revenue bond to pay for construction of a majority of the $10.6 million project. The bond is capped at a principal amount of $9 million, and will use revenues received from the Worthsville Road TIF district, Wright said. The city’s redevelopment approved issuing the bond last week and forwarded the proposal to the city council.

The remaining $1.6 million, would be paid for out of the parks department’s impact fees and operating funds, Wright said.

City officials decided to use a bond for the majority of the project because the TIF district has generated revenue more quickly than officials expected, Wright said.

TIF district revenue comes from the increased assessed value that has been added within the district following development. Several businesses in the Worthsville Road TIF district have reached the point where the companies are now paying a portion of their taxes, which has created significant enough revenue to move forward with the project, he said.

The bond will go through two rounds of votes by the city council. Final approval of the project is expected in May.

A timeline for construction was not immediately available.

In other news, tax abatements for three speculative buildings was introduced at the meeting.

The company 1173 Airport Parkway, LLC came before the council to request tax abatements for three flex-space, speculative office buildings that will be built west of Indy South Greenwood Airport. The company plans to invest $12.1 million and save a combined total of $327,185 in taxes, city documents show.

The buildings would receive abatements in a stair-step fashion. The first building would have a four-year abatement, the second would have taxes abated for three years and the third would have a two-year abatement, said Eric Prime, an attorney representing the developer.

If approved, one building would be built each year beginning in 2023. The buildings range from 28,800 square feet to 44,200 square feet in size, city documents say.

A public hearing on the abatements will take place at the city council’s next meeting on May 4.