Whiteland town council members gave the final OK to abate $3.5 million in taxes for the first building inside a massive mixed-use development planned at Graham and Whiteland roads.

Town officials are also working on final steps to take out a $7.25 million bond for the developer to pay for several improvements planned at the development

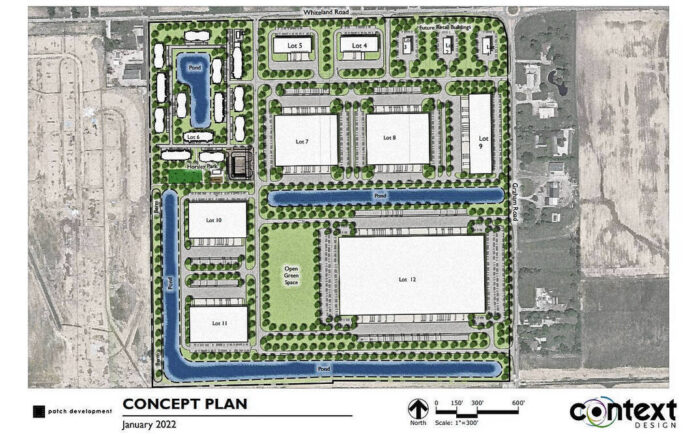

The first phase of Gateway at Whiteland — developed by Westfield-based Patch Development — includes building a 617,316-square-foot light industrial building at the back end of the property.

Plans for the entire 159-acre mixed-use development also include apartments, restaurant and retail spaces, and medium-size commercial flex-space buildings. However, that part comes later, and this tax abatement only addresses the first building.

Patch Development asked the town of Whiteland for a 10-year abatement, where Patch pays 45% in real property taxes to the town every year during that period. This differs from most traditional 10-year abatements, where the developer starts out paying no taxes, and pays more over the course of the abatement.

Patch plans to invest over $34 million into the land and improvements for this first phase in the mixed-use development. Over the 10-year abatement period, Patch Development will pay $3.65 million in real property taxes, while $3.5 million is abated.

The abatement originally passed the council in August, by a vote of 3-2, with council members Richard Hill and David Hawkins voting against it. A confirming resolution giving the final go-ahead for the abatement passed Tuesday by a vote of 4-0-1, with Hawkins abstaining.

Officials are also considering a proposal to give an approximately $7.25 million bond to Patch Development, in order to pay for infrastructure improvements, such as utilities and roads, for the first phase of construction on the nearly 160-acre property.

The bond, known as an Economic Development Revenue Bond, would be a 25-year bond, paid for with tax-increment finance, or TIF, funds generated directly from the Patch Development land. These bond funds would be loaned to Patch Development, so the debt would be in the developer’s hands, not the town’s.

Earlier this year, the town approved carving out the 160-acre Patch Development land, formerly known as the Horseley property, into its own TIF district. It is designated as the “Patch Economic Development Area,” according to town documents.

That means tax revenues generated from the development itself would then go back into the TIF paying off the $7.25 million bond — versus taking the money out of the four other already existing TIFs in Whiteland. The town is also projected to be collecting more than enough from the TIF to cover the debt over the 25-year period, according to Adam Stone, a local government financial consultant who presented the bond information to the council in August.

The proceeds of the bond could be used to finance the costs of utility improvements including electric, water, gas and sewer main improvements, roadway improvements, including improvements to Graham Road, stormwater improvements, and “other related infrastructure improvements in connection with the economic development project,” according to town documents.

Creating these type of financing agreements are becoming common in economic development deals, said Dennis Otten, a bond attorney with Bose McKinney and Evans, at the Tuesday council meeting.

“We do a bunch of economic development projects … this is the vehicle to get the incentive to the developer,” Otten said.

The city of Greenwood, for example, entered into a similar agreement using TIF bonds to finance some of a mixed-use project, The Madison, on Madison Avenue.

The Whiteland council approved the ordinance on first reading by a vote of 4-0-1, with Hawkins abstaining.

Hawkins said he took issue with a section in the ordinance that read the town council president and clerk-treasurer would have the power to sign off on any financial changes made to the project after the bond was issued. He suggested the town manager be added to that list, and it was amended, but he wanted the council to hold off on voting.

A public hearing for the bond proposal is scheduled before the Whiteland Economic Development Commission at 6 p.m. on Oct. 18 in the Whiteland Town Hall. Anyone from the public can attend to speak on the bond ordinance.

The town council plans to hold a special meeting that same evening to give a final vote on the proposal.