Greenwood mayoral candidates have made claim after claim about each other and the state of the city ahead of the May 2 primary.

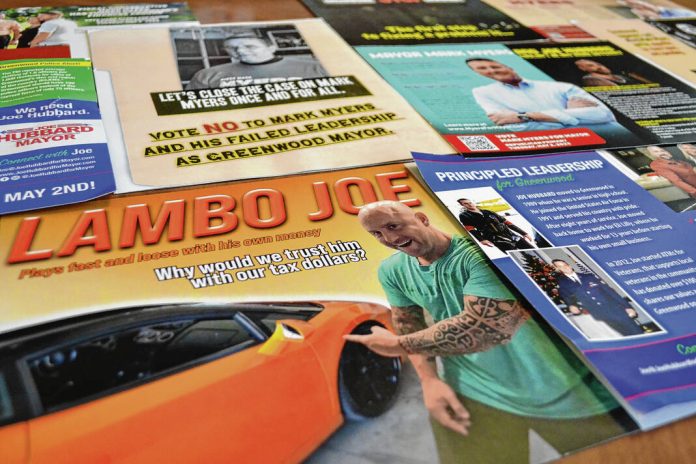

Dozens of mailers have been sent to Greenwood Republican voters sharing information about mayoral candidates Joe Hubbard and Mark Myers, with both making allegations about the other. The Daily Journal fact-checked several statements made in the mailers about both candidates.

CLAIM: Greenwood’s 2023 tax rate is lower than 2022, according to mailers from Myers’ campaign.

FACT CHECK: This is false. The 2022 city/town tax rate was $0.6533, and the 2023 rate is $0.6583 — an increase of $0.0050, according to property tax statements shared with the Daily Journal by Greenwood residents. When asked why the campaign said 2023 was lower than 2022, a Myers campaign spokesperson said it was a typo. The campaign’s intent was to highlight how the 2023 rate was lower than the rate in 2012, the spokesperson said.

The 2012 rate was $0.6728, or $0.0145 higher than the 2023 rate, data from Indiana Gateway and the Johnson County Auditor’s Office shows.

CLAIM: Joe Hubbard voted to allow a masking policy that was ultimately stricter than the state mandate while on the Center Grove school board.

FACT CHECK: This is partially true. In 2020, Hubbard voted for policy changes that required a mask mandate for students. The policy explicitly states that all students were required to “wear a face covering that covers their face and nose at all times.”

But during two meetings in August 2021 where the district’s 2021-22 Return to School plan came up, Hubbard voted against the plan both times. The plan’s recommendations focused on masks/face coverings, social distancing and seating, contact tracing and quarantines for students and staff.

CLAIM: Joe Hubbard’s Greenwood residence is in an “adults only” community, despite him having two teenage daughters, according to mailers from Myers’ campaign.

FACT CHECK: Around the time Hubbard’s residency was challenged, online rumors were spread saying he lived in an “adults only” community. Clearbrook Village, the neighborhood where he lives, does have a sign outside its entrance that says “adult only,” however it is not enforced.

During a Johnson County Election Board hearing in February regarding his residency, Hubbard testified that when he moved into the subdivision and read the homeowner’s association rules, there were no bylaws, declarations, or covenants that restricted the age of occupants or did not allow families to live there.

“All it says is they have to be owner-occupied,” Hubbard said at the time.

CLAIM: Joe Hubbard has declared bankruptcy, had a foreclosure, has been sued by creditors and had tax warrants filed against him, according to mailers from Myers’ campaign.

FACT CHECK: Federal and state court records show all of these claims are true.

Hubbard filed for Chapter 7 bankruptcy case in the Indiana Southern Bankruptcy Court in December 2013, and he reported $544,659 in liabilities, according to federal court documents obtained via PACER, the U.S. Government’s court records service. The debt was discharged in 2014, but two years later, in 2015, a trustee overseeing the case asked the court to revoke the discharge due to their belief that Hubbard had concealed assets, including some vehicles, according to court documents.

The trustee later withdrew their revocation request three months after making the initial request and the case was closed in 2018.

In 2012, the lender for Hubbard’s mortgage filed a foreclosure suit against Hubbard for defaulting on the mortgage. The home did sell at a sheriff’s sale in February 2017, according to state court records.

Hubbard was also sued by a creditor in April 2013 for unpaid personal debts, and a judgment was entered a few months later. Online court records show the sheriff’s office tried to serve on two different dates in 2013 after the judgment was reached, but were unable to reach him because Hubbard “lives and works in South America,” court records say.

Tax warrants were also filed against Hubbard by the state of Indiana in Johnson County courts in 2013. The warrants were for failing to pay withholding taxes while Hubbard was operating a sports bar in Camby, according to tax warrant records from Doxpop. The warrants were all later resolved.

Hubbard did not respond to a request for an interview to answer questions about these claims. In a statement, Hubbard said like other business owners, the Great Recession had a huge impact on his business which forced him to make a lot of tough decisions.

“Those experiences shaped me into who I am today and helped me to understand what it takes to be a successful business owner; not a career politician who lives off of taxpayer dollars,” Hubbard said. “As an Air Force veteran, I am proud of my business and our ability to donate back to veterans’ organizations.”

CLAIM: Mark Myers called for a local wheel tax, and supported adopting a local option sales tax and a Johnson County hotel tax, according to Hubbard campaign mailer citing an Accelerate Indiana Municipalities’ 2022 Policy Platform.

FACT CHECK: This is partially true. Accelerate Indiana Municipalities, or AIM, did advocate for those policies in its 2022 platform, and Myers was listed as an officer on AIM’s legislative committee on the platform document. It is not clear if Myers explicitly supported the policies himself.

A Hubbard campaign spokesperson defended the claim and said as a leader of AIM and a legislative committee member, Myers is responsible for what the group was advocating for.

CLAIM: Mark Myers supports regional mass transit and endorses local tax increases to pay for it, according to Hubbard campaign mailer citing an Indianapolis Star story.

FACT CHECK: This is partially true. The story the mailer was referring to was not actually from the Indianapolis Star, but from the Indianapolis Business Journal, a Hubbard campaign spokesperson said after being asked about where the information came from.

In the IBJ story from 2013, officials were discussing a transit bill that would create a nine-county transit district and would allow ballot questions in Marion and Hamilton counties on whether to raise local income taxes to help fund transit. The nine-county district would include Johnson County, according to the bill.

The Indiana Association of Cities and Towns — the predecessor of AIM — said that they supported the mass transit bill because it would be a test for similar initiatives in other metro areas.

Myers himself is not quoted in the story, but a Hubbard campaign spokesperson said it was included because Myers is part of that association.

CLAIM: Mark Myers supported a local food and beverage tax, supported taxing churches and nonprofits, and supported increasing the county’s local income tax, according to mailers from Hubbard’s campaign citing Daily Journal reports.

FACT CHECK: This is true. Over the years, Myers has been quoted in several Daily Journal stories advocating for a food and beverage tax.

In a 2013 story, Myers said he hoped it would help make it losses from property tax caps that limit how much local governments can collect in taxes. In 2019, Myers said he hoped the tax would help fund more police officers and firefighters, along with allowing the city to spend more on parks and recreation.

As for taxing nonprofits and churches, in October 2015 the city council unanimously turned down a proposal that would have charged churches and other nonprofits that locate or expand within tax increment financing, or TIF, districts a fee to help fund the government. The proposal had drawn criticism from several local churches.

The vote came after Myers asked the city council to remove the item from the agenda because of the controversy, but Myers said he wasn’t done with the idea, and planned to speak to other communities who had a similar fee about how it was approved and supported, the article says.

For the local income tax increase, the 2018 story cited in the mailer was about county officials weighing a tax increase to fund expanding the overcrowded Johnson County jail. Myers said in the story that he wanted county officials to consider a local income tax to help provide more funding for public safety. This came after previous attempts to pass a food and beverage tax failed, the story says.

CLAIM: The Greenwood City Council gave Mark Myers a pay increase of $10,000 for economic development in 2015, according to mailers from Hubbard’s campaign citing a 2015 Daily Journal report.

FACT CHECK: This is true. In the 2015 story, Myers was said to be getting a $10,000 raise because of a new development he brought to the city, and to raise his pay to be more comparable with mayors in similar communities. City council members also wanted to make sure the top official in the city had the highest pay, the story says.